Today’s Report is attached as a PDF.

What’s in Today’s Report:

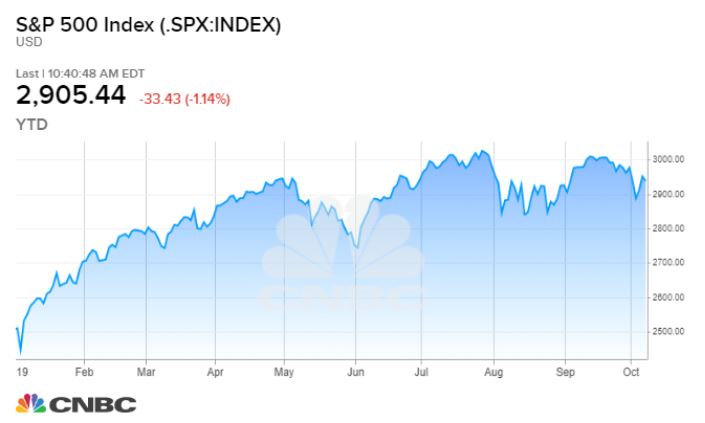

It is a mixed start to Q4 today as U.S. stock futures are modestly higher, Asian shares rallied overnight following a rate cut by the RBA (although Chinese markets are notably closed for a holiday), while European markets declined on soft economic data.

September Manufacturing PMI data remained decidedly weak in Europe with Germany’s headline index notably falling from 43.5 to 41.7, the lowest since June 2009. Inflation in the Eurozone meanwhile remains weak with the core HICP figure meeting estimates at 1.0% year-over-year.

Looking into today’s session, there are three economic reports to watch this morning: PMI Manufacturing Index (E: 51.0), ISM Manufacturing Index (E: 50.0), and Construction Spending (E: 0.3%) and a busy schedule of Fed speakers: Clarida (8:50 a.m. ET), Bullard (9:15 a.m. ET), and Bowman (9:30 a.m. ET).

Beyond those potential catalysts in the morning, markets will remain focused on the political drama surrounding the impeachment proceedings by the House against Trump as well as any further updates on the U.S.-China trade war as the latter continues to be the single most important influence on global markets right now.