Jobs Report Preview (All About Wages)

What’s in Today’s Report:

- Jobs Report Preview (All About Wages)

- Oil Update (EIA Analysis)

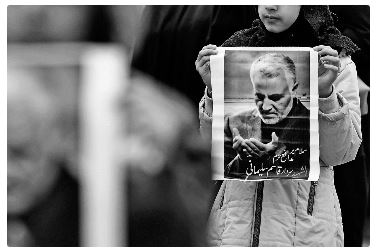

Futures are modestly higher as U.S./Iran tensions continue to recede.

There was no new geopolitical news overnight, and the rockets that hit the “Green Zone” in Iraq into the closing bell on Wednesday were a small, isolated event. As such, futures are essentially recouping that late-day dip.

Economic data was again mixed as German IP was better than expected, while German exports missed estimates.

Today there is one notable economic reports, Jobless Claims (E: 219K), and markets will want to see a continued decline that effectively reverses the Thanksgiving spike.

There are also numerous Fed speakers today including, in order of importance, Clarida (8:00 a.m. ET), Williams (11:30 a.m. ET), Kashkari (9:30 a.m. ET), Barkin (12:45 p.m. ET), Evans (1:20 p.m. ET). Broadly, markets expect a continued reiteration of the message that the Fed isn’t raising rates until inflation is sustainably higher.