Seizing Long Term Opportunities in Energy

What’s in Today’s Report:

- Seizing Long Term Opportunities in Energy

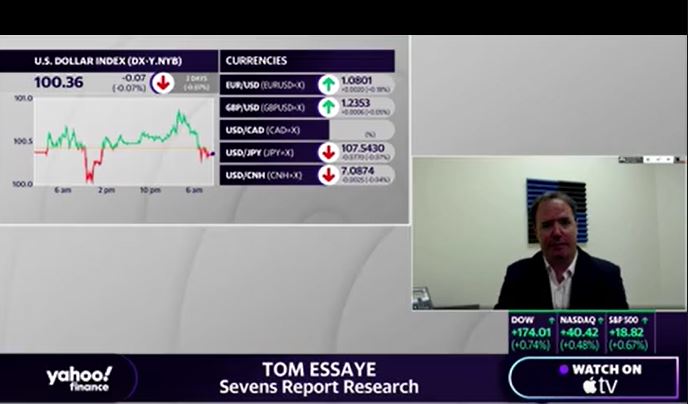

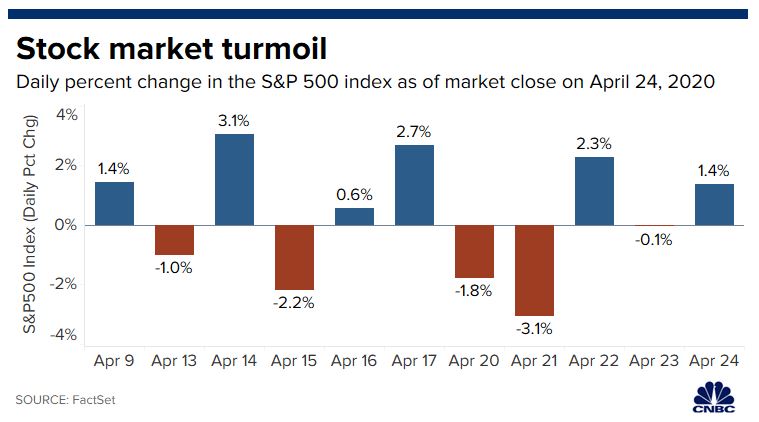

Futures are higher this morning while international equity markets are mixed as strong tech earnings offset soft economic data ahead of the FOMC Announcement today.

GOOGL is up 8% in pre-market trade after reporting strong Q1 results after the close yesterday while the European Commission’s Economic Sentiment Index fell more than expected, down to 67.0 vs. (E) 75.0 as the fallout from the coronavirus pandemic has weighed heavily on business activity.

Today, there are two economic reports to watch: GDP (E: -3.8%) and Pending Home Sales Index (E: -5.4%) but the main focus during the primary session will be on the FOMC Meeting Announcement (2:00 p.m. ET) followed up by Fed Chair Powell’s Press Conference (2:30 p.m. ET).

Earnings season also remains in full swing with: BA (-$2.04), MA ($1.72), HUM ($4.84), NOC ($5.42), YUM $0.64), SHW ($4.01), and VLO (-$0.19) all reporting ahead of the bell while MSFT ($1.27), FB ($1.72), QCOM ($0.80), and TSLA (-$0.53) release their Q1 results after the close.

The main thing investors are looking for today is reassurance from the Fed, specifically that they remain committed to doing “whatever it takes” to support the economy through the COVID-19 pandemic and are focused on restoring the economy to its previous state as quickly as possible.