An Important Chart (Valuation & Asset Inflation)

What’s in Today’s Report:

- What Buffet’s Favorite Measure of Valuation Can Tell Us About Asset Inflation

- FOMC Minutes: Why They Weren’t “Hawkish”

- EIA: Oil Market Outlook

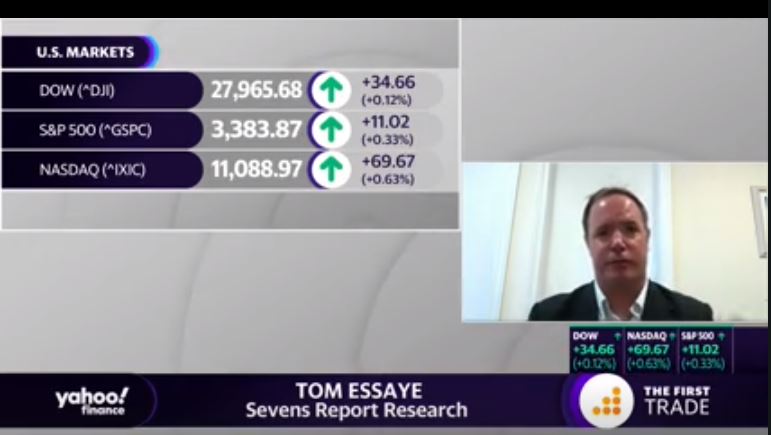

Futures are marginally lower mostly on continued momentum from Wednesday’s late-day market decline.

It was a quiet night of news and “Fed disappointment” is the most used excuse for the decline in stocks, although the FOMC Minutes largely met expectations (more on that in the report).

Stimulus chatter about a “skinny” stimulus bill (worth $500/bln) continues to grow. If that becomes reality, it will be a big disappointment (remember markets have priced in a $1.5T bill).

Today the key reports will be Jobless Claims (E: 963K) and Philadelphia Fed Survey (E: 21.5), and the point here is clear: Markets will want to see continued improvement in the data in August, reflecting the fact that the loss of stimulus isn’t causing the economic recovery to slow or pause. Finally, there’s one Fed speaker today, Daly (1:00 p.m. ET), but he shouldn’t move markets.