What’s in Today’s Report:

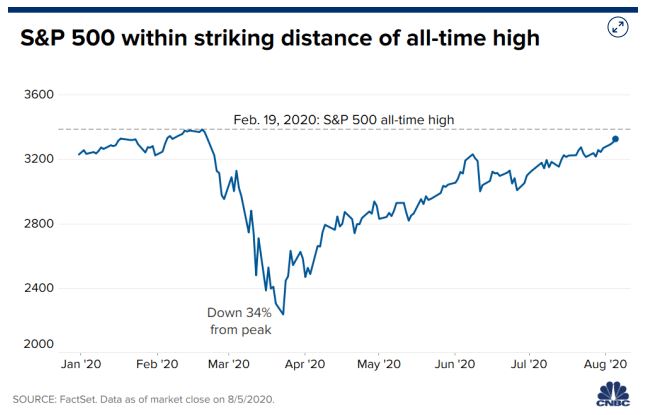

- Market Multiple Levels: S&P 500 Chart

- Is the Jobs Market Rolling Over? (ADP Data was Deceiving)

Futures are little changed as solid economic data is offsetting mildly negative stimulus headlines.

Regarding stimulus, the headlines over the last 12 hours were slightly negative (more sticking points are emerging) but the market still expects a deal within the next few days and for that deal to be at the upper end of expectations (the weekly unemployment payments are looking to be $400/week into year-end, which is higher than market expectations).

Economic data was solid as German Manufacturers’ Orders (27.9% vs. (E) 9.6%) and the British Construction PMI (58.1 vs. (E) 57.0) both beat estimates.

Today the focus will be on the weekly Jobless Claims (E: 1.442M), and simply put the market does not want to see any further increases in weekly claims as that implies the recovery is pausing. A number above 1.5MM will likely put a headwind on stocks today (unless there’s positive stimulus headlines). There’s also one Fed speaker, Kaplan (E: 10:00 a.m. ET), but he shouldn’t move markets.