What’s in Today’s Report:

- Dow Theory Update: The Transports Continue to Lag

- Gold Update

Futures are down slightly as the recent run to new highs in the S&P 500 is digested after a quiet start to the week.

Trade optimism faded modestly overnight amid several less encouraging news articles while there were no notable economic data releases overseas.

Today is lining up to be a busy day as there are a lot of potential market catalysts to watch ahead of the G20 this weekend.

On the economic data front, there are several housing numbers due out: Case-Shiller HPI (E: 0.2%), FHFA House Price Index (E: 0.2%) and New Home Sales (E: 680K) as well as Consumer Confidence (E: 132.0).

There are also multiple Fed speakers: Williams (8:45 a.m. ET), Bostic (12:00 p.m. ET), Powell (1:00 p.m. ET), and Bullard (6:30 p.m. ET). Powell will clearly be the most important to watch, however it remains very unlikely that his tone changes much (or at all) from last week’s FOMC press conference.

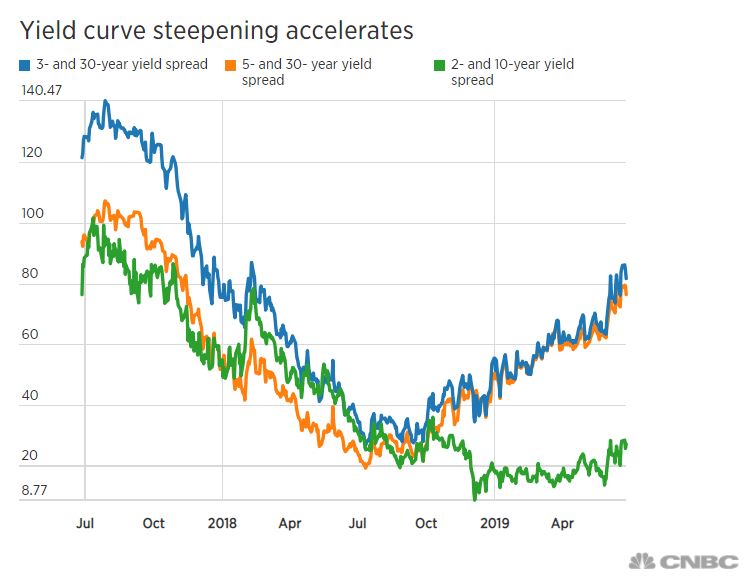

There is also a 2 Year T-Note Auction (1:00 p.m. ET) and if demand is soft (so yields rise) that could pressure stocks as it would show the market is dialing back expectations for a very dovish Fed in the back half of 2019.

Lastly there are a few companies reporting earnings today, but the FDX report after the close will be the key to watch as the release could offer insight (positive or negative) into the latest influence that U.S.-China trade tensions have had on global trade.