What’s in Today’s Report:

- Another Positive for Financials

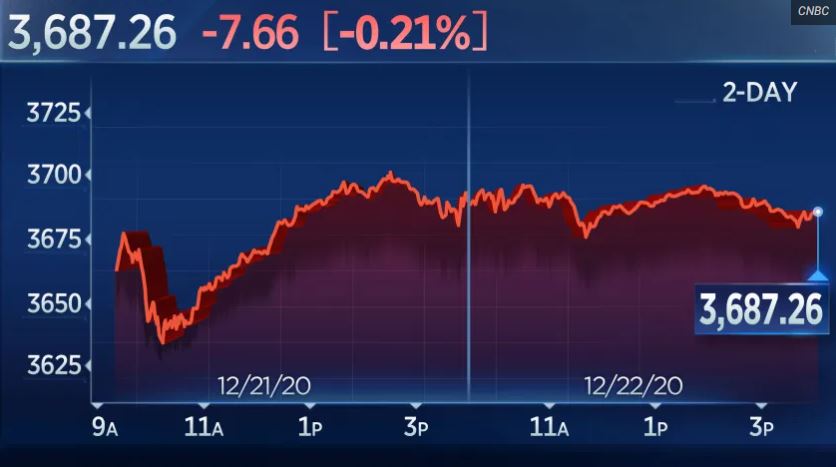

- Nasdaq Hits Fresh Record (Chart)

Futures declined overnight after President Trump threatened to veto the recently passed stimulus bill but markets have since stabilized as hopes for fiscal aid remain strong and investors look ahead to a slew of economic data today.

Late Tuesday, Trump said he hoped Congress would increase the amount of direct payments to individual American from $600 to $2,000 and remove unnecessary spending in the package however the bill is still likely to become law given the overwhelming Congressional support which is easing market angst this morning.

Today, there is a long list of economic data due to be released including Durable Goods Orders (E: 0.6%), Jobless Claims (E: 875K), Core PCE Price Index (E: 1.5%), New Home Sales (E: 989K), and Consumer Sentiment (E:81.0).

If the data is better than expected, that could help lift equity markets after several days of heavy trading while the impact of disappointing data will be limited given the optimism of the new aid package in the works.

Beyond the data, investors will be continuing to watch coronavirus statistics and lockdown measures as the latest surge in cases and hospitalizations remains a risk to the economic recovery and any negative developments could weigh on risk assets in thinning holiday trade.