What’s in Today’s Report:

- Why 2021 Could Start With a Bang (In Stock and Bond Markets)

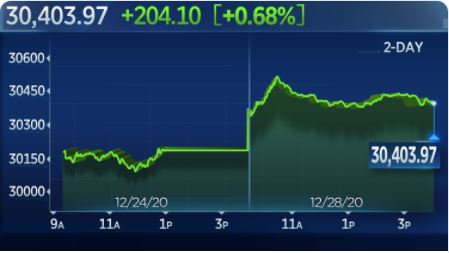

Futures are slightly higher following a generally quiet night of news.

Economically, the only notable report was the Chinese December Manufacturing PMI, which declined from November but slightly beat estimates at 51.9 vs. (E) 51.5.

On the stimulus front, despite the recent drama of the last few days, the payouts to people in the stimulus bill will not be increased to $2000. However, if Democrats win the Senate, expect this issue to come up again in early 2021.

Today focus will be on Jobless Claims (E: 830K) and markets will want to see continued improvement in that weekly data to imply the economic recovery has not lost meaningful momentum. Outside of that and some year-end positioning, today should be a generally quiet day (although markets will get busy again starting next week).