The New Market Dynamic (Lockdowns and Stimulus)

What’s in Today’s Report:

- Navigating the New Market Dynamic (Lockdowns and Stimulus)

- Weekly Economic Cheat Sheet: The Key Number is Today’s Flash PMI

- Weekly Market Preview: Lockdowns vs. Vaccine Optimism, Round 2.

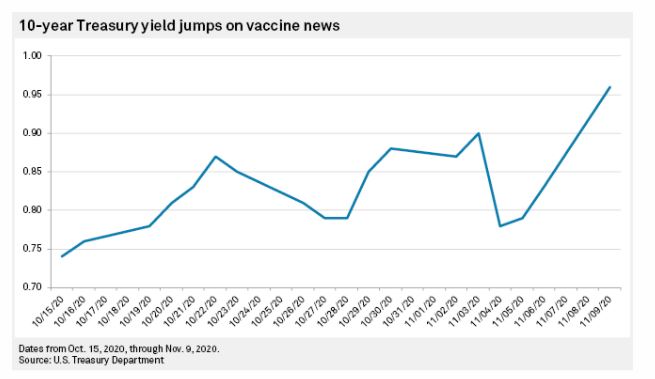

Futures are moderately higher as the Astra-Zenica vaccine accountment is helping to offset still surging COVID cases and more economic lockdowns.

Astra-Zenica (AZN) announced its COVID-19 vaccine was 70% effective against the disease, but 90% effective when given in two doses (making it essentially on par with the Pfizer and Moderna vaccines).

Economically, flash November PMIs were mixed as the EU PMI missed estimates, while the UK PMI beat expectations, but both numbers declined from the October levels, reflecting the lockdown-related headwinds on the economy.

Today the key number is the November Flash Composite PMI (E: 55.6). Markets will want to see stability in that number, but if it’s a bad miss then markets will grow more nervous about a potential “double dip” recession in early 2021, and that will hit markets regardless of the AZN vaccine news.