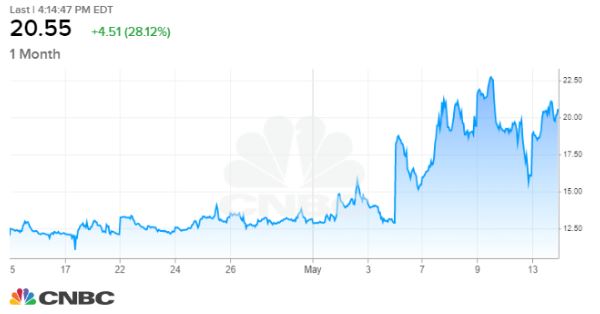

A U.S.-China Tech War Too?

What’s in Today’s Report:

- Why the Trade War is Becoming a Tech War (And That’s Bad)

- Brexit Update – Is a “No Deal” Brexit A Possibility (Yes)

- EIA and Oil Update – Bearish Supply News

It’s an ugly morning as futures are down about one percent as markets digest disappointment from the week’s two big events, the FOMC Minutes and the global flash PMIs.

EU flash PMIs missed estimates at 51.6 vs. (E) 51.7 but EU and German manufacturing PMIs were especially weak (47.7 & 44.3) and that’s negative for global growth.

Yesterday’s FOMC Minutes were slightly hawkish and confirmed the Fed isn’t close to a rate cut right now.

Given the soft foreign data, the key report today is the flash Composite PMI (E: 52.4). If that number is soft, it’ll further stoke worries about global growth and will be a negative for stocks. Other reports today include Jobless Claims (E: 215K) and New Home Sales (E: 680K).

Bottom line, this market is facing several headwinds and support at 2800 is now important, but should likely hold unless hopes for a Trump/Xi meeting at the G-20 meeting are dashed, or U.S. growth begins to roll over.