What’s in Today’s Report:

- Technical Update – Levels to Watch

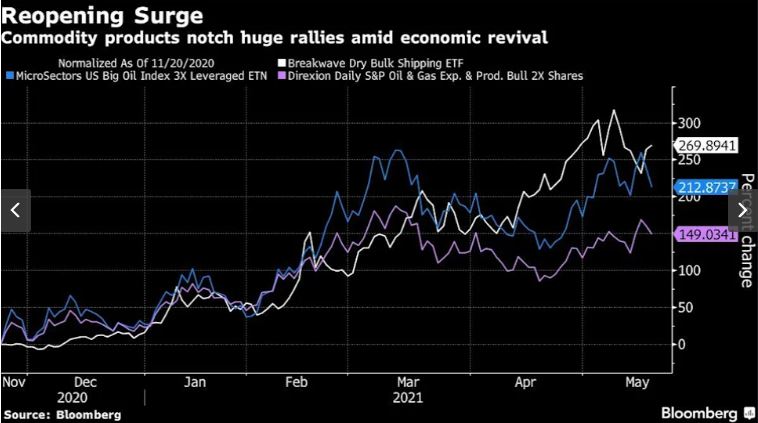

Futures are moderately higher on momentum from Thursday’s rebound combined with a drop in industrial metals’ prices, which is helping to ease some anxiety on inflation.

Iron ore prices dropped sharply overnight as Chinese officials stated they would take measures to curb price increases in various industrial metals and that headline is pushing back on the “surging inflation” narrative (although it doesn’t change the inflation outlook).

There was no notable economic data overnight nor any important central bank speak (outside of the China metals news it was a quiet night).

Today we get several notable economic reports including Retail Sales (E: 1.0%), Industrial Production (E: 1.2%), and Consumer Sentiment (E: 90.3). In general, the stronger the better for these reports but we’ll be watching the inflation expectations component of the Consumer Sentiment Index – if it runs “hot” expect a headwind on stocks. There’s also one Fed speaker, Kaplan (1:00 p.m. ET), but he shouldn’t move markets.