What’s in Today’s Report:

- Why Doesn’t This Market Care That There’s No Stimulus?

- Weekly Market Preview: Watching Washington and the Data

- Weekly Economic Cheat Sheet: August Flash PMIs on Friday – Can the Data Hold Up?

Futures are marginally higher following some potentially positive headlines from Washington over the weekend.

Speaker Pelosi is calling the House back into session to address Postal Service funding (this was a major sticking point in the larger stimulus bill). The hope is that if there’s a compromise on that issue, the larger stimulus bill becomes much easier to pass.

There was no notable economic data overnight.

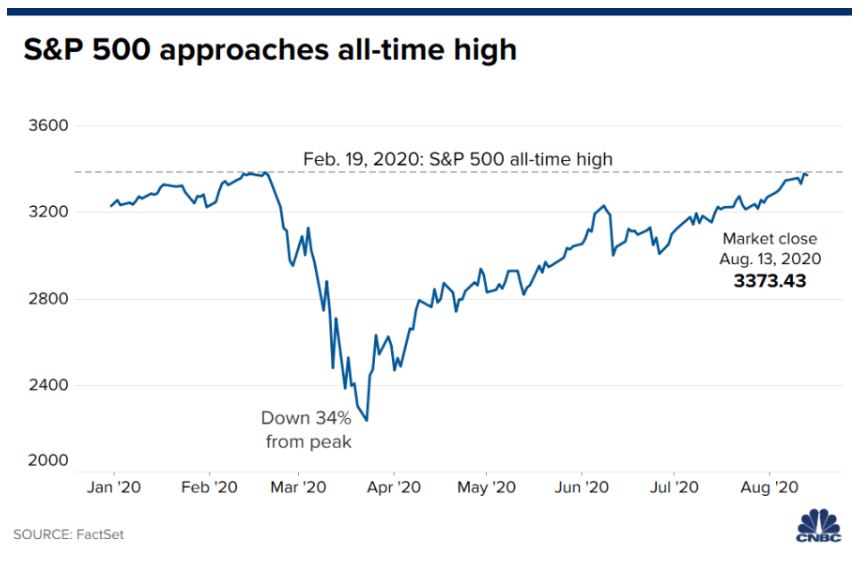

Today’s focus will be on Washington and specifically if there’s any hint that negotiations may re-open on the larger stimulus bill. If that’s the case, then we’ll likely see new all-time highs today in the S&P 500.

Economically, the Empire Manufacturing Index (E: 17.0) is the key report today, and the market will want to see continued progress from July (especially because the stimulus payments have stopped). We also get the Housing Market Index (E: 72), although that shouldn’t move markets.