A Familiar Question: 1998 or 2000?

What’s in Today’s Report:

- Stimulus Negotiations Update

- A Familiar Question: 1998 or 2000? (Yield Curve Update)

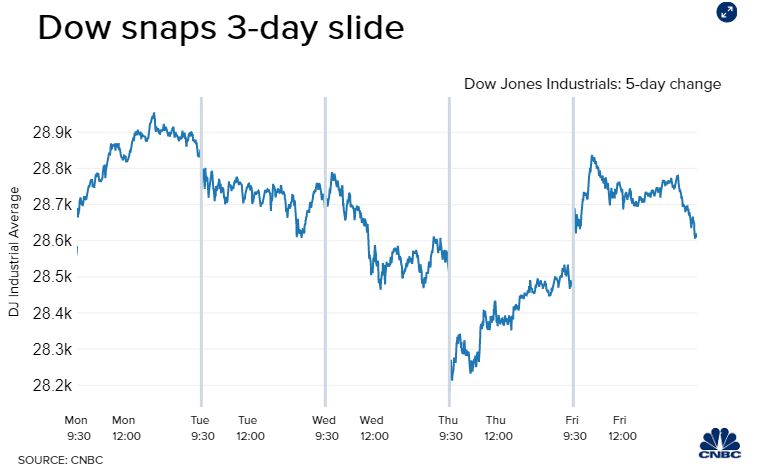

Stock futures are flat after wavering between gains and losses overnight as investors hold out hope for a last minute stimulus bill while COVID-19 cases continued to rise around the globe.

There were no notable economic releases overnight and no major data points are due to be released today.

Looking into today’s session the lack of economic data will leave investors interested in Fed chatter with several officials speaking over the course of the day: Brainard (8:50 a.m. ET), Mester (10:00 a.m. ET), Kaplan, Daly, & Kashkari (12:00 p.m. ET), Barkin (1 p.m. ET).

Earnings will also continue to be closely watched with multiple notable reports due to be released today: VZ ($1.22), WGO ($0.90), AN ($1.63), TSLA ($0.58), CMG ($3.44), CSX ($0.93), and DFS ($1.63).

While the aforementioned factors will continue to be monitored by investors today, stimulus remains by far the most important influence on markets right now and any progress towards a sizeable, market friendly deal that is actually passable in the near term could trigger a big rally in stocks. Conversely, if talks fall apart and the timeline for a deal is pushed back, we could see stocks begin a potentially steep pullback on the news.