What’s in Today’s Report:

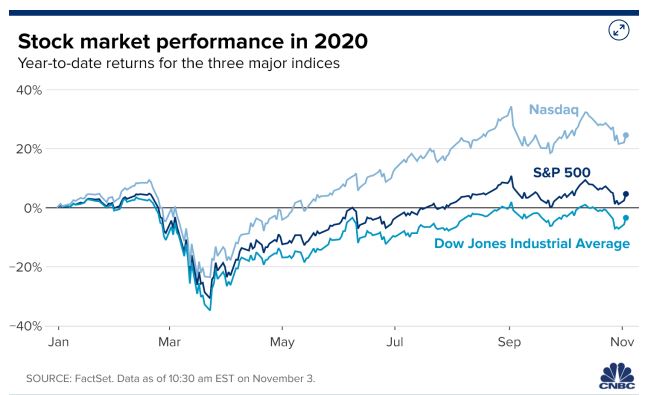

Stock futures are rising with global shares this morning as the U.S. election comes into focus after a mostly quiet night of news.

There were no notable economic reports or market-moving COVID-19 developments overnight leaving investors focus almost exclusively on today’s election.

There are two economic reports today: Motor Vehicle Sales (E: 16.5M) and Factory Orders (E: 0.6%) but neither should move markets and no Fed officials are scheduled to speak ahead of this week’s FOMC meeting.

There are a few notable earnings releases to watch today that could influence sector trading: MCK ($3.87), HUM ($2.86), SYY ($0.20), and PRU ($2.69) but none of the quarterly reports are likely to have a significant impact on the broader market.

Today, the election will clearly be in the forefront of investor focus, specifically how close the races in key swing states turn out to be. Ultimately, the markets want clarity, and the main threat to risk assets this week is the emergence of a contested election, so if races are tight enough for campaigns to sue to halt or extend recounts, expect a reversal of this morning’s rally and potentially significant risk-off money flows in the sessions ahead.