What’s in Today’s Report:

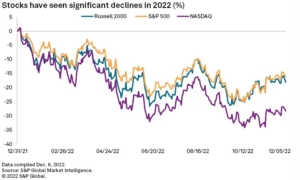

- Market Multiple Table December Update: Macro Improvement But It’s More Than Priced In

- November ISM Services Index Takeaways

Futures are little changed this morning despite a stabilizing bond market and mostly positive global news flow overnight as yesterday’s hawkish money flows are digested.

Economically, German Manufacturer’s Orders rose 0.8% vs. (E) -0.2% in October suggesting that factory demand may be stabilizing.

In China, new Covid cases have declined for 8 consecutive days and the government is reducing testing requirements, bolstering optimism about a move away from the crippling Zero Covid policies.

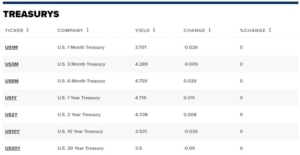

Today is lining up to be a fairly slow day of news with just one lesser followed economic release: International Trade in Goods and Services (E: -$80.0B) and no Fed speakers as they remain in their pre-meeting blackout period. That said, equity markets will likely queue off of Treasuries and if we see a further rise in shorter-duration yields due to rising terminal rate expectations, yesterday’s declines could very well continue.

Annual Discounts on Sevens Report, Alpha, and Quarterly Letter

We’ve recently been contacted by advisor subscribers who wanted to use the remainder of their 2022 pre-tax research budgets to extend their current subscriptions, upgrade to an annual (and get a month free) or add a new product (Alpha or Quarterly Letter).

If you have unused pre-tax research dollars, we offer month-free discounts on all our products when billed on an annual basis.

If you want to extend current subscriptions or save money by upgrading to an annual subscription (across any Sevens Report product), please email info@sevensreport.com.