What’s in Today’s Report:

- Why Didn’t Cyclicals Outperform Following the Stimulus Announcement?

- Another Positive for the “Get Out and Spend” Names?

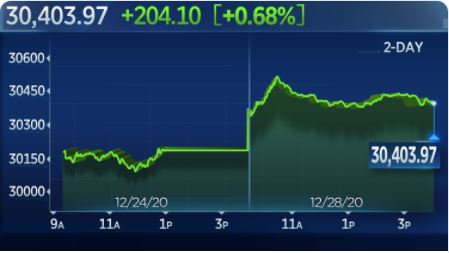

There is a clear risk-on tone to markets this morning with U.S. equity futures tracking global shares higher while the dollar tests recent lows on hopes for more stimulus in thin holiday trading volumes.

Yesterday, the House overwhelmingly passed a bill proposing stimulus checks be increased from $600 to $2,000, which now moves to the Senate with an uncertain fate but there is growing optimism it will pass.

From a catalyst standpoint, today is lining up to be relatively slow as there is just one lesser followed economic report: Case-Shiller House Price Index (E: 0.7%) and there are no Fed speakers.

The Treasury will hold a 7-Yr Note Auction at 1:00 p.m. ET which could impact the yield curve but it is unlikely to be a large enough move to affect equity markets.

That will leave trader focus on Capitol Hill once again as the bill to increase stimulus payments moves to the Senate. While it is relatively unlikely to pass, the Presidential support for the increase is helping drive optimism that it does and such a large increase in individual payments would be a clear positive for risk assets (and dollar negative), especially given this week’s thin attendance and light volumes.