Weekly Market Cheat Sheet: May 8, 2017

The Sevens Report is the daily markets cheat sheet our subscribers use to keep up on markets, leading indicators, seize opportunities, avoid risks and get more assets. Get a free two-week trial—no obligation, just tell us where to send it.

Last Week in Review:

Economic data last week, highlighted by the strong jobs report, helped to somewhat narrow the gap between soft sentiment surveys and hard economic data… although it’s fair to say that gap remains open and is still a headwind on stocks, just a slightly less strong one. It was not all positive last week, though, as we got several signs of potential loss of momentum in China, which was an underreported but potentially important development last week. Finally, the Fed meeting proved to be a non-event, except in that it reaffirmed a June rate hike is likely (but that’s already mostly expected from the markets).

Starting with the jobs report, it met our “just right” scenario. The overall job adds were strong at 211k vs. (E) 185k, but revisions to the March report were negative 19k, so the net number was more in line. The unemployment rate dropped to 4.4%, but that was in part due to a decline in the participation rate. Meanwhile, year-over-year wage increases declined to 2.5% from 2.7%. Bottom line, this number was “fine,” but it wasn’t massively reflationary (in part due to the wage number) and that’s why we didn’t see the strong headline jobs report ignite an immediate reflation rally in stocks (again, the wage number undermined the strong job adds).

Looking at other economic data last week, there were more positives than negatives, highlighted by the ISM Non-Manufacturing PMI, which hit 57.5 vs. (E) 55.8. That strong Non-Manufacturing PMI helped to offset the soft April Manufacturing PMI, which dipped to 54.8 vs. (E) 56.5 while the New Order component dropped below 60 for the first time in five months. While disappointing vs. expectations, it’s important to remember that the absolute level activity remains strong.

Turning to the Fed, the key takeaway from last week’s Fed meeting was that the Fed viewed the loss of economic momentum in Q1 as “transitory,” and still said risks to growth were “roughly balanced.” Both terms are Fed speak for, “We’re going to hike in June despite the soft Q1 GDP.” The market largely expects that (Fed Fund futures have a hike priced at 83% (which is close to a universal conclusion).

Finally, I want to take a moment and focus on Chinese economic data from last week, as the numbers were universally disappointing. Official April Manufacturing PMI dropped to 51.2 vs. (E) 51.7 while composite PMI declined to 51.2 vs. previous 52.1. Additionally, iron ore went into quasi freefall this week, as iron ore futures ended limit down on the Dalian Commodities Exchange on Wednesday night. The drop came after the Chinese steel industry PMI dropped below 50, signaling contraction. Oversupply has something to do with the price drop as well (exports are surging out of Australia) but the bottom line is that base metal prices are a coincident indicator of economic activity. The declines in iron ore, steel and copper last week, combined with the under-whelming Chinese data, definitely caught our attention. We now are officially watching this closely for everyone, and will keep you updated.

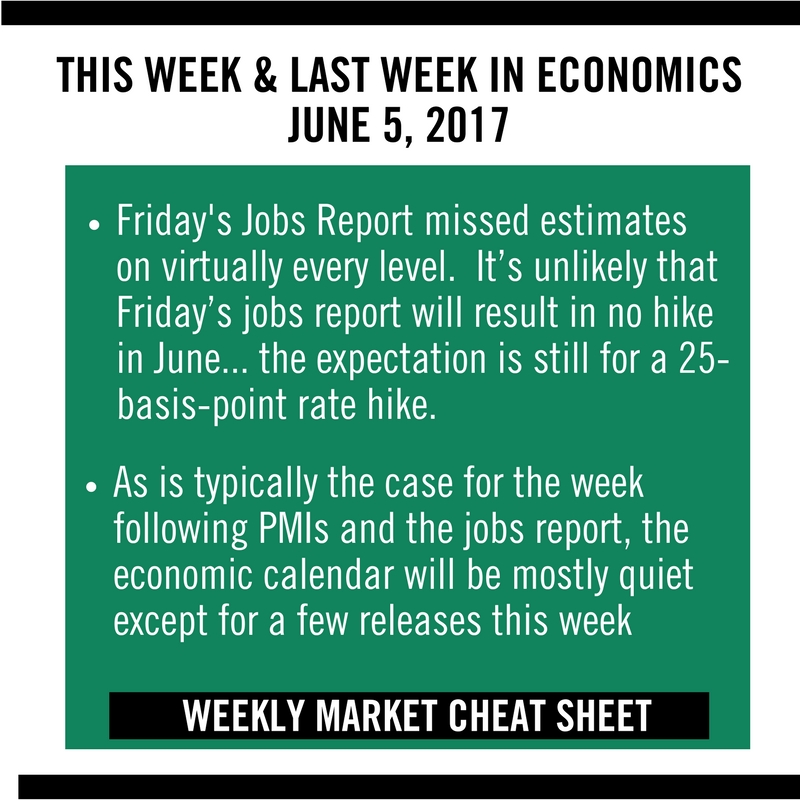

This Week’s Cheat Sheet:

This week, April CPI and April Retail Sales (both Friday) are the important reports to watch. The latter is more important for markets at this point than the former, as we need to see a rebound from Q1’s paltry consumer spending. If retail sales fail to show progress and beat expectations, it’ll widen the gap between soft data and hard economic numbers. With CPI, we should see some mild cooling of the recent uptick in inflation, but overall inflation pressures continue to slowly build.

Outside of those two numbers, focus will be on the Chinese CPI and PPI, as again data there suddenly turned lower last week. Bottom line, it should be a quiet week, but retail sales and CPI are important as the “gap” between soft sentiment surveys and hard economic data remains… and it needs to close further if we are going to see a breakout in stocks.

Get the simple talking points you need to strengthen your client relationships with the Sevens Report. Everything you need to know about the markets delivered to your inbox by 7am each morning, in 7 minutes or less.