What is Earnings Per Share?

“It’s a good thing I’m retiring soon, because after almost 38 years in the business almost nothing makes sense in the markets anymore. So it’s a good thing I have you, who understands the way things work today.”

That’s what Reed, an advisor and subscriber, wrote to me yesterday.

If a guy with nearly four decades of experience in the business is confused by today’s markets, it’s a reasonable assumption that a lot of advisors feel overwhelmed and confused by a market that seems to be getting more random every day.

But, Reed’s comments reinforced in my mind that our research is helping advisors successfully navigate today’s environment, as thousands of the most successful advisors in the business who felt overwhelmed or confused by the markets over the past few years now use our daily morning report to cut through the noise and stay focused on what’s really driving stocks, bonds, commodities and currencies.

They’ve found that spending less than 10 minutes reading The Sevens Report

each morning gives them time to focus the rest of their day on growing AUM and building their businesses.

As I often do with testimonials, I hung Reed’s comments on my wall, because they remind me that advisors are counting on us to help them continue to grow their business by making them more efficient and more effective.

If you’re like most advisors I know, you simply do not have enough time to do the necessary research to understand what’s truly driving these wild markets, because you need to spend the majority of your time meeting with prospects, marketing, hand-holding current clients and dealing with an ever-growing list of compliance and regulatory requirements.

We provide the accurate, plain English, succinct research that allows advisors to dedicate more time to these revenue generating activities, because they know at 7 a.m. every day they will have a report emailed to them that explains what’s important across all asset classes:

- Stocks

- Bonds

- Currencies

- Commodities

And, we’ve been doing it for our paid subscribers all year long:

- In December, we alerted subscribers to the deterioration in energy-related credit, and explicitly cited the risks to the high-yield bond market. So, when stocks broke down on a plunge in high yield, our subscribers weren’t caught off guard and they could demonstrate to their clients that they are on top of the volatility and ahead of the markets, which ultimately builds confidence and solidifies relationships.

- In January we focused on the Chinese yuan as the leading indicator for stocks and told our subscribers that when it stabilized, stocks would stabilize (and that’s exactly what happened).

- In February and March, we alerted our subscribers to the decline in US oil production and warned that if it continued, oil would bottom as would stocks (it did, and they did).

-

Most recently, we have been monitoring several key leading indicators as we navigate the “post-Brexit” world. So far we have called the market reaction correctly.

Now, there’s a new driver of markets, and it’s an obscure valuation formula called the Equity Risk Premium that large investors are using to justify this grind higher in stocks.

And until the market is fully valued (based on this formula) we continue to think the short-term path of least resistance for stocks is higher, despite underwhelming fundamentals.

We’ve included an excerpt of that research for you below as a courtesy:

What Is the Equity Risk Premium, and Why Is It So Important Right Now?

It’s a bit of “revenge of the nerds” in the markets right now, because one of the stealth factors behind this grind higher in stocks has been a largely academic valuation formula called the Equity Risk Premium.

This matters to you (and your clients) because it will show us:

1) Where (at least fundamentally) this market is overvalued and where we need to begin to reduce equity exposure, and

2) See why a rise in bond yields could kill this rally.

First, though, a primer on the Equity Risk Premium (this is review for those of you recalling your finance of Capital Asset Pricing Model classes). The Equity Risk Premium (ERP) is basically a fancy term for the risk/return setup in stocks (equities). Stocks are obviously historically riskier than bonds, so the ERP is the additional return (or reward) an investor expects when investing in stocks over Treasuries, and for taking on excess risk (higher risk/higher return).

But, depending on a multitude of factors, that expected return on stocks and expected return on Treasuries changes, so the ERP changes. In today’s market, thanks to relative macroeconomic calm, and based on the perception of a global central bank safety net, market consensus for the equity risk premium is about 4%.

Here’s how it’s calculated:

-

First, you find the forward looking S&P 500 P/E, which is currently about 16.75 (2180/$130).

-

Second, you take the inverse of that number (so 1/16.75 = 5.97%). That number, 5.97%, is the return the market is currently expecting from stocks in 2017.

-

Third, to get the Equity Risk Premium, we have to subtract the 10-year yield because we want additional return beyond investing in Treasuries over the next year. The current yield on the 10 year is 1.58%, so our ERP is: 5.97% – 1.58% = 4.39%.

Given that number, we can generate a few conclusions:

Conclusion #1: 2340 in the S&P 500 is a potential top for this market. Assuming macro-economic calm, investors should keep buying the market until the ERP = 4.00. So, assuming bond yields stay low (and that is important) an ERP of 4% = 2340 in the S&P 500 or 7.5% higher from the current level.

If we get to that level (or approach it) I would likely begin to reduce equity market exposure, as beyond that stocks are simply very, very overvalued.

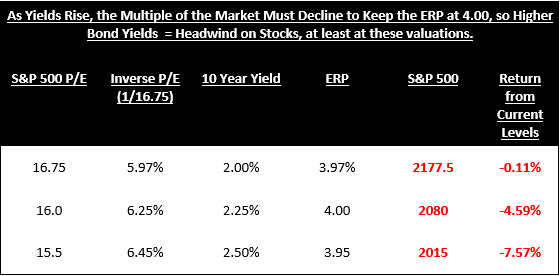

Conclusion #2: If Treasury yields rise to 2% or higher, this market will likely correct (potentially hard). To illustrate how important 10-year Treasury yields are to stocks, you have to understand one point: As Treasury yields rise, the ERP goes down.

As the 10-year yield rises, multiples must come down to keep the ERP above the 4% floor. As a result, so too must the S&P 500. If the 10-year yield moves back to 2.5% (which is a long way away), then to keep the ERP at the 4% floor the S&P 500 needs to trade with a 15.5X multiple, which at $130 EPS is 2015, or 8% lower from here.

Conclusion #3: An 4% ERP is historically very low, and smacks of “exuberance.” I did some digging, and most people think a reasonable/historical ERP is between 5%-7%. In fact, I only found one instance where it dipped below 4%, and that was early 2008! (the data was off the NYU Stern School of Business website).

Given how active central banks are right now, we can probably dip that number below 5%. But if we get an anticipated macro headwind and we see the ERP move back into the mid 4%, that could result in significant downside for the S&P 500 of anywhere between 8% and 14%, depending on the level of the 10-year yield.

Bottom Line

I realize that following the Equity Risk Premium isn’t a priority for most of today’s advisors, but what is important is making sure that both prospects and clients feel confident you understand markets! And, our subscribers have found that reading our daily report (again, emailed every day at 7 a.m.) helps them stay on top of markets while saving them research time.

That creates more time for meetings and calls, which we all know leads to more AUM.

Finally, it’s well documented that affluent investors are weary of this stock market.

Yes, we all know it’s being inflated by the Fed, but many of us feel that this market now is just another bubble that will pop at some point. So, affluent clients want to know their advisor is constantly watching for signs that the bubble is going to pop, because avoiding another pullback in markets will be the key to outperforming over the next several years. Our subscribers know we are watching that for them, and the Equity Risk Premium is just the latest indicator we’re tracking for signs of trouble.

We’ll continue to watch the ERP and adjust it as yields move, and keep you abreast of any changes that are bullish or (more importantly) bearish. In order for this equation to balance, and keep the ERP at 4%, the P/E of the market must decline—which is negative for stocks.

Make sure you have a daily research document that gives you peace of mind in volatile markets.

We’ll directly tell you (in plain English) what’s truly important in markets and provide consistent tactical idea generation so you can outperform for your clients, regardless of the environment.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Value Add Research That Can Help You Grow Your Business in 2016

Our subscribers have told us how our focus on medium-term, tactical opportunities and risks has helped them outperform for clients and grow their businesses.

We continue to get strong feedback that our report is: Providing value, helping our clients outperform markets, and helping them build their books:

“Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!” – Top Producing FA from a National Brokerage Firm.

“Let me know if there is anything else that you need from us. Thanks again for everything. I really enjoy the Report – it is helping me grow my business and stay on top of things.” – Independent FA.

“Great service from a great company!!” – FA from a National Brokerage Firm.

“Great report. You’ve become invaluable to me, thanks for everything…! – FA from a Boutique Investment Management Firm.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The Sevens Report right now.

Begin your subscription to The Sevens Report right now by clicking this link and being redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report