FOMC Preview

What’s in Today’s Report:

- FOMC Preview (Wildcard to Watch)

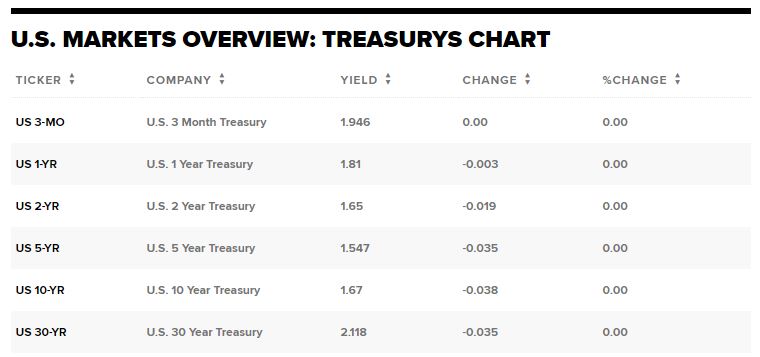

- What Do Rising Treasury Yields Really Mean?

S&P 500 futures are down roughly 1% this morning tracking European shares lower after German trade data showed a much larger than anticipated drop in exports during the depths of the COVID-19 pandemic in April.

Eurozone GDP and the NFIB Small Business Optimism Index slightly beat expectations however German exports declined by the most on record in April, tumbling by -24.0% on the month which is weighing heavily on EU shares today.

Looking into today’s session, there are two lesser followed economic reports due to be released: April JOLTS (E: 5.750M) and Wholesale Trade (E: 0.4%) which are not likely to move markets while there are no Fed speakers as the June FOMC Meeting Begins today.

With tomorrow’s Fed announcement and Powell’s press conference coming into focus, it is possible we see a continued wave of profit taking today, especially given the disappointing economic data out of Europe, however a sense of “Fed paralysis” should keep the losses somewhat limited.