What’s in Today’s Report:

- What’s Expected/Priced In This Week from Washington?

- Durable Goods Orders – Takeaways

- Energy Update: Fundamentals, Technicals, and Momentum All Favor the Bulls

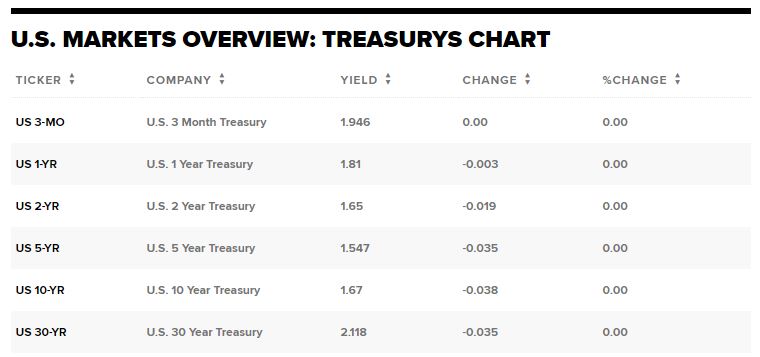

U.S. equity futures are decidedly lower this morning as Treasury yields continue this week’s surge higher. The 10-year note yield topped 1.52% in overnight trading which is weighing heavily on high valuation tech names today.

From a catalyst standpoint, today is lining up to be a busy day with a slew of economic data due to be released: International Trade in Goods (E: -$87.0B), Case-Shiller Home Price Index (E: 1.6%), FHFA Home Price Index (E: 1.5%), and Consumer Confidence (E: 114.8).

Of those releases, the market will be most interested in whether or not Consumer Confidence can stabilize following the disappointing August print.

There is a 7-Year Treasury Note action at 1:00 p.m. ET and given how much bonds are influencing stocks so far this week, the results could impact equity markets (strong demand would help stabilize stocks, weak demand would likely see losses extended).

Finally, there are multiple Fed speakers today including: Evans (9:00 a.m. ET), Powell (10:00 a.m. ET), Bullard (1:40 & 7:00 p.m. ET), and Bostic (3:00 p.m. ET). Focus will clearly be on Powell and any insight he may provide regarding inflation expectations and the Fed’s plans to react.

Bottom line, the stock market is being driven by the bond market this week and if we see bonds continue to drop (yields spike higher) then that will result in further underperformance by growth stocks and drag the broader market lower while stabilization in yields would likely allow for a rebound.

Sevens Report Q3 Quarterly Letter Coming October 1st.

The Q3 2021 Quarterly Letter will be delivered to advisor subscribers on Friday, October 1st.

With Fed tapering, Washington budget battles and possible tax hikes looming, Q4 could be the most volatile of the year. Our quarterly letter will help you set the right expectations for clients so they aren’t blindsided by any market volatility.

You can view our Q2 ’21 Quarterly Letter here.