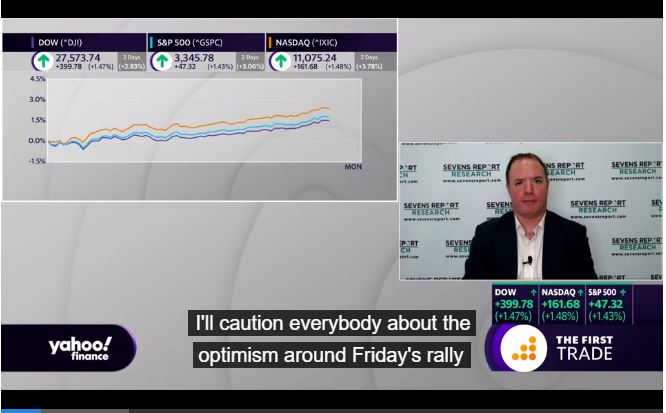

Tom Essaye Quoted in Benzinga on October 8, 2020

On Thursday, Sevens Report Research’s Tom Essaye said the market isn’t ignoring the headlines. It’s simply assuming everything will work out for the best in the coming months…Click here to read the full article.