Posts

Stock Market Update: 12/21/16

/in Investing/by Tyler Richey

Stocks rallied modestly Tuesday, as a mild resumption of the Trump trade carried the major averages close to all-time highs. The S&P 500 rose 0.36%.

Stocks were higher from the outset Tuesday as the BOJ was, on balance, slightly dovish and data from Europe was good (German PPI was hot as was British Distributive Trades).

From a micro-economic standpoint, Jefferies’ earnings were better than expected (a boost to financials). Stocks popped at the open and then, amidst a total dearth of any incremental news, drifted sideways for the remainder of the session.

Mid-morning and mid-afternoon there were two attempts to push stocks down into negative territory, but with no news to disrupt the current positive narrative the selloffs didn’t generate any momentum. Stocks bounced into the close to finish just off their best levels of the day. Overall, it was an extremely quiet and uneventful trading session.

Trading Color

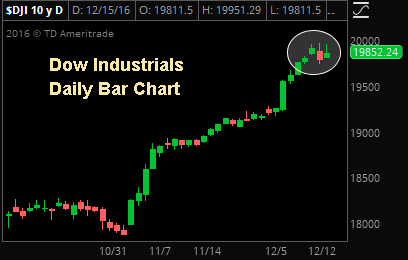

With no bad news to shake the current outlook, the Trump trade was back on in modest form yesterday. Small caps and cyclicals again outperformed, and industrials were also strong (the Dow hit an all-time high, although it failed to break above 20k).

From a sector standpoint, financials led as XLF was the only SPDR we track to close up more than 1%. Banks were also very strong as KRE rose nearly 2%. The Jefferies’ results helped those names rally, but with yields rising again there was already a tailwind there.

Most other sectors were little changed as staples, energy and healthcare closed with very mild losses while basic materials, tech, utilities and industrials all notched small gains.

Consumer discretionary was the only other sector that moved notably as XLY rose 0.80% thanks to some buying in NKE ahead of earnings (which were better than expected). But retail in general is facing an ever-increasing headwind as corporate tax reform begins to take shape .

The Market’s Bell with WSJ Best-Selling Author Simon Constable

/in Investing/by Tyler RicheyWSJ best-selling author Simon Constable puts a little British spin on the US economy where to invest now. He’s fun, brutally honest and wicked smart.

Address

4880 Donald Ross Rd., Suite 210

Palm Beach Gardens, FL 33418

info@sevensreport.com

Phone

(561) 408-0918