Weekly Market Cheat Sheet, September 11, 2017

Last Week in Review

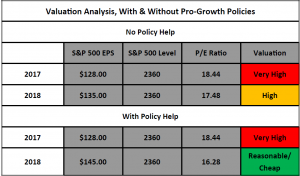

The economic data remains remarkably consistent: Growth data remains good but not great while inflation data relentlessly disappoints. From a market standpoint, that means that the economy isn’t at imminent risk of a material loss of momentum, but at the same time there are no signs of the type of acceleration that would lead to a rising tide carrying stocks higher.

From a Fed standpoint, inflation remains lackluster, and that’s causing a reduction in expectations for a December rate hike. That’s not a medium/longer-term good thing for stocks, because it further throws into doubt the chances for reflation—and economic reflation remains the key to sustainably higher stock prices.

Looking at last week’s data, there weren’t many numbers, but the numbers we got reinforced the “slow growth/low-inflation” trend.

The ISM Non-Manufacturing PMI (or service sector PMI) rose to 55.3 from 53.9. So, there was acceleration in activity in August. But that acceleration missed estimates of 55.8, and while a number in the mid-50s is solid, it’s not the type of number that implies we’re seeing real acceleration.

The other notable number last week that was largely ignored by the media was August productivity and unit labor costs. An uptick in productivity, if it’s consistent and material, could lead to an economic acceleration.

The reason for that is simple: The economy is basically at full employment. But, if those workers get more productive, the total economic output increases, and we get a stronger economy.

August productivity rose to 1.5% vs. (E) 1.3%, so that is a good sign. It’s not nearly the acceleration we need, but it’s a step in the right direction.

However, that productivity number wasn’t the important one from this release. The important number was unit labor costs. Rising unit labor costs is a precursor to larger inflation, so it’s an important number. And, unfortunately, it once again missed expectations. Unit labor costs rose 0.2% vs. (E) 0.3%, providing even more fodder for the “doves” on the Fed to not hike rates in December.

Finally, turning to the ECB meeting last week, you know by now it was slightly hawkish. Draghi signaled the ECB will reveal the details of QE tapering at the October meeting, and he again chose not to try and “talk down” the euro, which led to the euro hitting new multi-year highs (and the dollar hitting multi-year lows).

From a market standpoint, that dollar weakness is a slight tailwind on US stocks, although not a material one. Until we get better inflation or growth data here in the US, the trend of euro strength/dollar weakness will continue.

This Week’s Preview

All the important economic reports this week come out Thursday and Friday, which is nice because that gives us a bit of time to get ourselves squared away following all the hurricane issues from last week.

The most important number this week is CPI, out Thursday. As you know, inflation remains the key issue with the economy and Fed expectations. Frankly, we need CPI to start firming because it’ll give us hope of a looming economic reflation. If, however, this number disappoints, as it has for a few months, we’ll see new lows in the dollar and new lows in Treasury yields, neither of which are a good thing for stocks beyond the very short term.

After CPI, there are three important growth numbers out this Friday: Retail Sales, Industrial Production and Empire Manufacturing Survey.

Starting with the first two, remember there remains a large gap between “hard” economic data and surveys. Put plainly, actual economic data is not rising to the level that’s being implied by the PMIs and/or consumer confidence. The longer that occurs, the more likely it is that the surveys are exaggerating economic growth.

So, the sooner hard economic data begins to accelerate, the better. If retail sales and industrial production can beat estimates, that will be an economic positive.

Turning to Empire Manufacturing, that’s the first data point from September, and that’s always anecdotally important because we don’t want to see any steep drop off that might imply a loss of momentum.

Bottom line, this week gives us more color into the state of growth and inflation in August. We need to see both begin to accelerate if we are to hold out hope that we can see an economic reflation create a “rising tide” for stocks in Q4 ’17 or Q1 ’18.

Time is money. Spend more time making money and less time researching markets every day. Subscribe to the 7sReport.com.