Oil Futures End Lower

Oil futures end lower: Sevens Report Co-Editor, Tyler Richey, Quoted in MorningStar

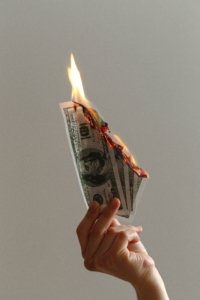

Oil futures end lower as demand worries outweigh forecasts for supply deficit

The latest U.S. inflation reading ran on the “hot side,” especially on the core figure, which will “bolster the case for a ‘higher for longer’ Fed policy rate outlook, said Tyler Richey, co-editor of Sevens Report Research. That raises the threat that the central bank “chokes off growth and sends the economy into recession,” which is never a good scenario for oil demand.

Also, click here to view the full MorningStar article published on September 13th, 2023. However, to see the Sevens Report’s full comments on the current market environment sign up here.

If you want research that comes with no long term commitment, yet provides independent, value added, plain English analysis of complex macro topics, then begin your Sevens Report subscription today by clicking here.

To strengthen your market knowledge take a free trial of The Sevens Report.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.