What’s in Today’s Report:

- What Would a Warren Presidency Mean for Markets?

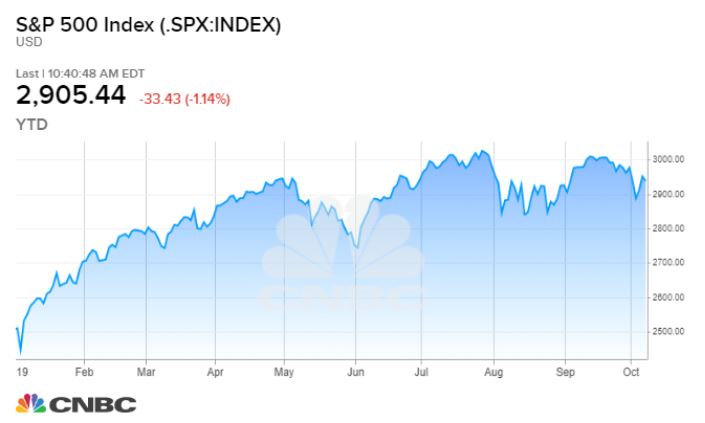

Stock futures reversed from overnight gains and are now decidedly lower with EU shares after the Trump administration expanded its “blacklist” to 20 Chinese companies and Chinese officials said to “stay tuned” for retaliatory measures.

Economically, the Chinese Composite PMI firmed to a multi-month high of 51.9 last month (although the services component was mildly underwhelming) and German Industrial Production was not as bad as feared (0.3% vs. E: -0.1%), while the NFIB Small Business Optimism Index was inline.

Today, there is one economic report to watch in the morning: PPI (E: 0.1%) and then the Treasury will hold a 3-Yr Note Auction at 1:00 p.m. ET (auctions have had an impact on the yield curve recently and as a result, moved markets).

Later in the day, there are a few notable Fed speakers: Evans (1:35 p.m. ET), Powell (1:50 p.m. ET), and Kashkari (5:00 p.m. ET), and while investors will watch Powell’s speech closely, the main influence on markets remains the trade war this week and as such, traders will continue to be most sensitive to any further developments or statements released by the White House or Beijing.