Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

Last Week in Review

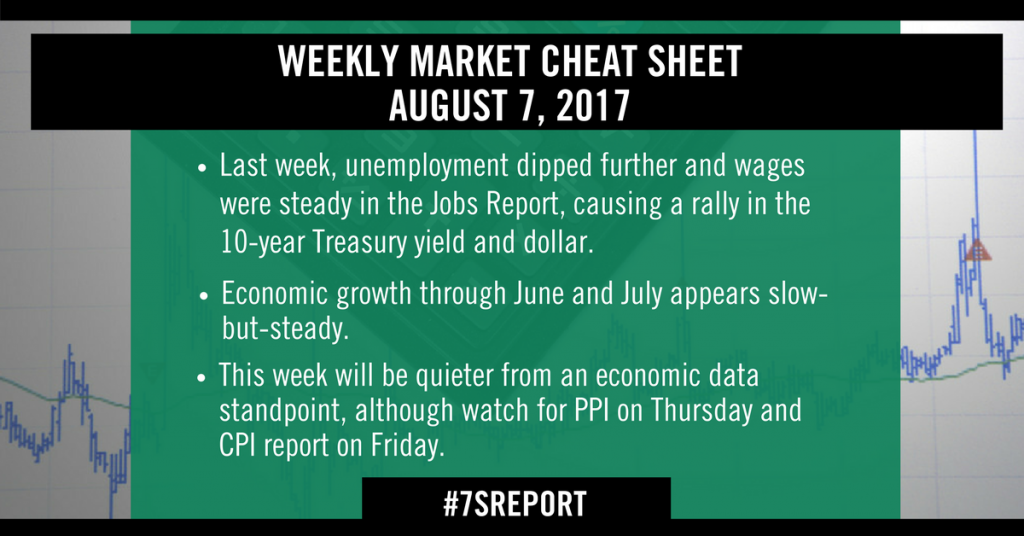

There was more underwhelming economic data last week, especially on the inflation front, as the prospects for an economic reflation in 2017 continued to dim.

From a Fed standpoint, the disappointing CPI and PPI reports further reduce the chances of a rate hike in December, although importantly the Fed is still expected to begin to reduce its balance sheet in September.

Starting with the headline numbers, CPI and PPI, they were both disappointing. The Producer Price Index declined to -0.1% vs. (E) 0.1% while the core figure was flat vs. (E) 0.2%. Meanwhile, the CPI report was slightly less underwhelming at 0.1% vs. 0.2% on the headline, and the same for the core.

While these aren’t horrible numbers, they aren’t good either, and the bottom line is that statistical inflation

remains stubbornly low, and it is appearing to continue to lose momentum. Again, for context, that’s a problem because in this environment, with (supposedly) strong economic growth and low unemployment, inflation should not be going down. Period. And the longer it goes on, the more it sparks worries that eventual deflation or disinflation will rise, and that’s not good for an economy with still-slow growth and extended asset markets.

Bottom line, even before the uptick in North Korea jitters this was a market in need of a positive catalyst to spur further gains. Unfortunately, the economic data (ex-jobs and sentiment surveys) has been consistently underwhelming, so the chances of a rising tide driven by an economic reflation continue to dim. And while a “dovish” number may be good for a mild pop in the S&P 500, soft data and a lower dollar/bond yields aren’t going to drive the market to material new highs.

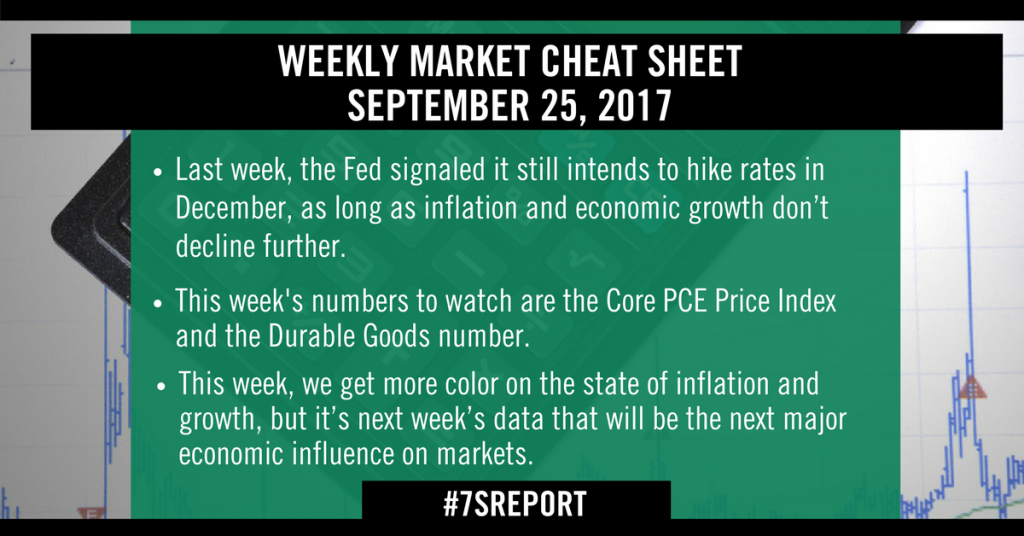

This Week’s Preview

This week is busy, with mostly anecdotal data that will give us a better overall picture of the economy and inflation—and the main risk to stocks now is that the data comes in light, and along with low inflation that spurs fears of an economic loss of momentum. If that happens, stocks will take out last week’s lows.

The most important report this week will be tomorrow’s Retail Sales report. Consumer spending has been lackluster for most of 2017, but around now we see a typical seasonal uptick. That will be welcomed by markets if that appears again this year. If the number is soft, it’s going to spur worries about the pace of economic growth (remember, hard economic data hasn’t been great all year, it’s been the PMI surveys that have been strong).

Beyond retail sales, we also get a first look at August economic data via the Empire and Philly manufacturing indices. Both numbers haven’t been highly correlated to the national PMIs lately, but it’s still our most-recent economic data and it could move markets, especially if we see any weakening in the data. Empire comes tomorrow and Philly comes Thursday.

Turning to central banks, we get the Fed minutes from the July meeting on Wednesday, and the ECB minutes from the July meeting on Thursday. The Fed minutes are important because we will be looking for clues as to how eager or committed the Fed is to September balance sheet reduction. With the ECB, the key will be seeing how committed or eager the ECB is to announce tapering of QE in September. As is usually the case, there shouldn’t be any big surprises in these minutes, but they could slightly shift expectations for those two events (balance sheet reduction/announcement of tapering), and as such also move Treasury yields and Bund yields.

Finally, July Industrial Production and Housing Starts also come this week (Thursday and Wednesday,

respectively). Again, these are an opportunity for the hard data to rise and meet strong soft data surveys, and in doing so reassure investors that the economy’s accelerating.

Bottom line, none of the numbers this week are “major,” but in aggregate they will give us a lot more insight into the pace of economic growth and the outlook for the Fed and ECB. And, this market needs some economic reassurance to help bolster sentiment after last week. Better data and steady Fed/ECB are a needed boost markets this week.

Time is money. Spend more time making money and less time researching markets every day. Subscribe to the 7sReport.com.