What Is the Yen Carry Trade?

What’s in Today’s Report:

- What Is the Yen Carry Trade and Why Does it Matter to Markets?

- Manheim Used Car Index Takeaways

- S&P 500 Chart – Summer Uptrend Has Been Violated

Markets are risk-off this morning thanks to soft Chinese economic data, disappointing UPS earnings and guidance (shares are down over 6% in the premarket), and negative banking sector news in the U.S. and Europe.

Economically, Chinese exports fell -14.5% vs. (E) -12.6% in July, the steepest drop since the pandemic while imports also fell much more than expected which raises further concerns about the health of the Chinese economy, which was supposed to be a major source of global growth this year.

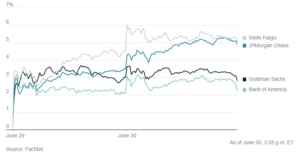

A surprise windfall tax on bank profits announced by the Italian government paired with Moody’s downgrading 10 smaller U.S. banks is weighing heavily on financials this morning and acting as a headwind on the broader equity indices as well.

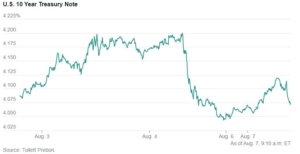

Looking into today’s session, there is one economic report to watch: International Trade in Goods and Services (E: -$65.4B) and two Fed speakers: Harker (8:15 a.m. ET) and Barkin (8:30 a.m. ET), all scheduled for before the opening bell. The trade data shouldn’t move markets but if Harker and/or Barkin strike a more hawkish than anticipated tone today, that could send bond yields higher and weigh on equities.

Finally the Treasury will hold a 3-Yr Note auction at 1:00 p.m. ET and any meaningful moves in yields (higher or lower) could influence equity market trading this afternoon.