The 10-Year Yield Sits at 5.00%

The 10-Year Yield Sits at 5.00%: Tom Essaye Quoted in Barron’s

10-Year Treasury Yield Hovers Around Milestone 5% Level, Adding Pressure to Stocks

“The 10-year yield sits at 5.00% as of this writing. And the higher it goes today, the lower stocks will likely fall,” said Tom Essaye, founder of Sevens Report Research. “Today, any progress on electing a Speaker of the House will be welcomed by the markets and likely push yields lower.”

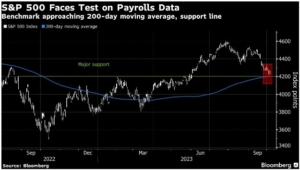

The recent, dramatic march higher in yields has added significant headwinds for stocks. Because higher returns on risk-free government debt tend to dampen demand for riskier bets, such as equities.

Also, click here to view the full Barron’s article published on October 23rd, 2023. However, to see the Sevens Report’s full comments on the current market environment sign up here.

If you want research that comes with no long term commitment, yet provides independent, value added, plain English analysis of complex macro topics, then begin your Sevens Report subscription today by clicking here.

To strengthen your market knowledge take a free trial of The Sevens Report.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.