Tyler Richey Co-editor of the Sevens Report Quoted in Barron’s on January 27, 2021

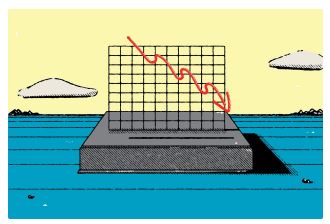

Tyler Richey of Sevens Report Research tells Barron’s that an ongoing short squeeze may also weigh on the broader market. In order to fund the ability to buy back stocks that were previously shorted, long-short hedge funds must sell existing holdings…Click here to read the full article.