Why Are Yields Rising?

Why Are Yields Rising? Start a free trial of The Sevens Report.

What’s in Today’s Report:

- Why Are Yields Rising?

- What the Removal of Speaker McCarthy Means for Markets (We Didn’t Need This Right Now)

- JOLTS Data Takeaways

- OPEC+ (JMMC) Meeting Preview

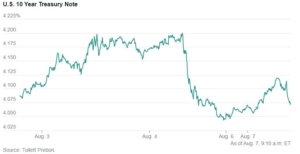

U.S. stock futures are rebounding from overnight losses as European markets turn positive following mixed economic data while yields are stabilizing after this week’s rapid rise.

Markets are continuing to digest the implications of the removal of McCarthy as Speaker of the House. Yields were initially higher overnight, likely on worries of a more pronounced threat of a government shutdown next month. They have since stabilized and are only little changed in morning trade, helping support steady stock futures in the pre-market.

Economically, the September EU Composite PMI came in at 48.7 vs. (E) 48.4, while Retail Sales fell -1.2% vs. (E) -0.2% in August and PPI fell a steep -11.5% vs. (E) -11.7%. On balance, the data was not a reason for the ECB to become more hawkish. Which is helping global bond markets (and equities) stabilize this morning.

Today, focus will be on economic data early with the ADP Employment Report (E: 150K), ISM Services Index (E: 53.5), and Factory Orders (E: 0.2%). The “hot” JOLTS headline roiled markets yesterday so markets are likely to welcome any cooling labor market indicators and look for easing price measures in the ISM release as those developments could help bonds bounce back and stocks recover some of this week’s losses.

Later, the focus will turn to central bank speak with several Fed officials scheduled to speak including: O’Neill Paese, Schmidt, Bowman, and Goolsbee. A lot of hawkish rhetoric has been digested in recent sessions. So any more dovish-leaning commentary would also be welcomed by stocks and other risk assets.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.