Did Trump Just Kill The Reflation Trade? April 13, 2017

Did Trump Just Kill The Reflation Trade? An excerpt from today’s Sevens Report.

President Trump, in an interview with the WSJ yesterday, appeared to change his policy on the Fed and interest rates. Specifically, Trump said he thought the dollar was getting too strong, that he favored a low interest rate policy, and he was open to keeping Yellen as Fed Chair. It was the second two comments that caught markets attention and caused a “dovish” response in the dollar and bond yields (both of which fell).

President Trump, in an interview with the WSJ yesterday, appeared to change his policy on the Fed and interest rates. Specifically, Trump said he thought the dollar was getting too strong, that he favored a low interest rate policy, and he was open to keeping Yellen as Fed Chair. It was the second two comments that caught markets attention and caused a “dovish” response in the dollar and bond yields (both of which fell).

The reason these comments were a surprise was because it was generally expected Trump wouldn’t keep Yellen and was in favor of a more hawkish Fed Chair and appointing more hawkish Fed governors (there are currently three vacancies on the Fed President Trump can fill).

So, the market was expecting Trump to be a hawkish influence over the coming years, but yesterday’s comments contradict that expectation.

Going forward, from a currency and bond standpoint (the short term reaction aside) I do not see Trump’s comments as a dovish gamechanger for the dollar or rates. Yes, near term it appears the trend for the dollar is sideways between 99.50ish and 102 while the 10-year yield has broken below support at 2.30%.

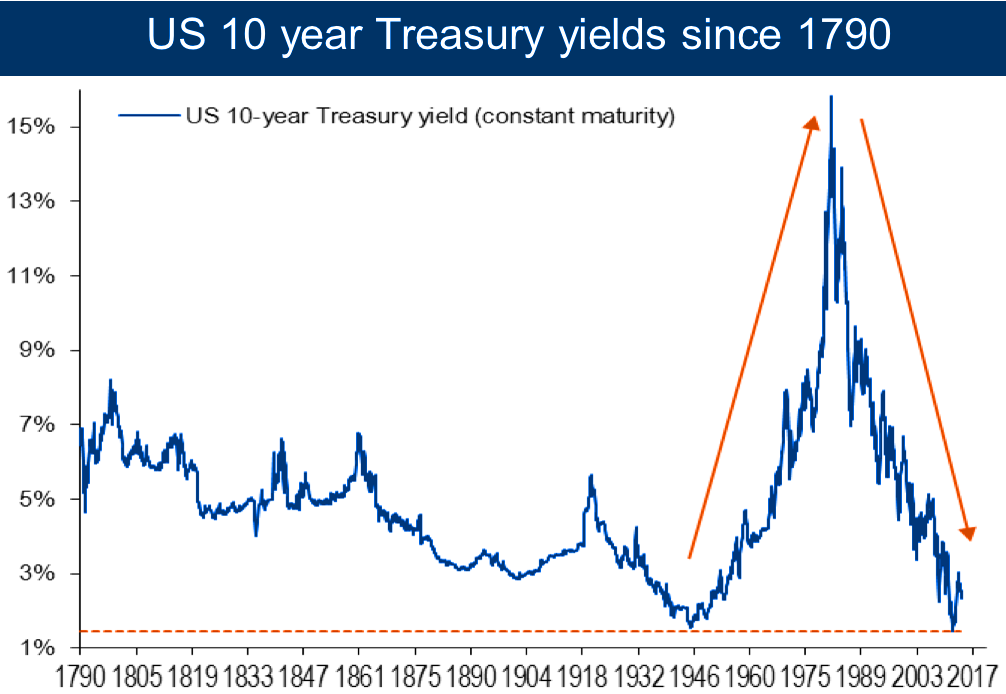

But, I don’t see Trump’s comments sending the dollar back into the mid 90’s, nor do I see them sending the 10 year yield below 2%.

I also don’t expect this dovish reaction to be a material boost for stocks, because dovish isn’t positive for stocks any more (in fact the comments are causing the stock sell off this morning—more on that in minute).

Bigger picture, the longer-term path of the dollar and bond yields will be driven by growth, inflation and still ultra-accommodative foreign central banks.

Better economic growth (either by itself or with policy help) is the key to the longer-term direction of the dollar and rates (and we think that longer-term trend remains higher).

However, in the near term, his comments sent the 10 year yield decidedly through support at 2.30%, and that is causing stocks to drop as Treasury yields continue to signal that slower growth and lower inflation are on the horizon. And, since the market has rallied since the election on the hopes of better growth and higher inflation (i.e. the reflation trade) this drop in yields is hitting stocks.

The violation of support in the 10 year yield at 2.30% is important and a potentially near term bearish catalyst for stocks. If the ten year yield doesn’t stabilize and make some effort to rally over the next few days, a test of 2300 or 2275 in the S&P 500 would not shock me.

Cut through the noise and understand what’s truly driving markets, as this new political and economic reality evolves. Get your free 2-week trial at the Sevens Report.