Trumponomics Update, May 17, 2017

/in Investing/by Tom EssayeJoin hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you. Politics remains a deafening influence on the markets in 2017, but amidst the ongoing circus (which again got bigger overnight) I wanted to step back and […]

What Direction is the Pain Trade?, May 16, 2017

/in Investing/by Tom EssayeThe Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Sign up today for a free two-week trial. Longer term readers know that one of the better indicators we use to determine the near-term trend of markets is the “pain […]

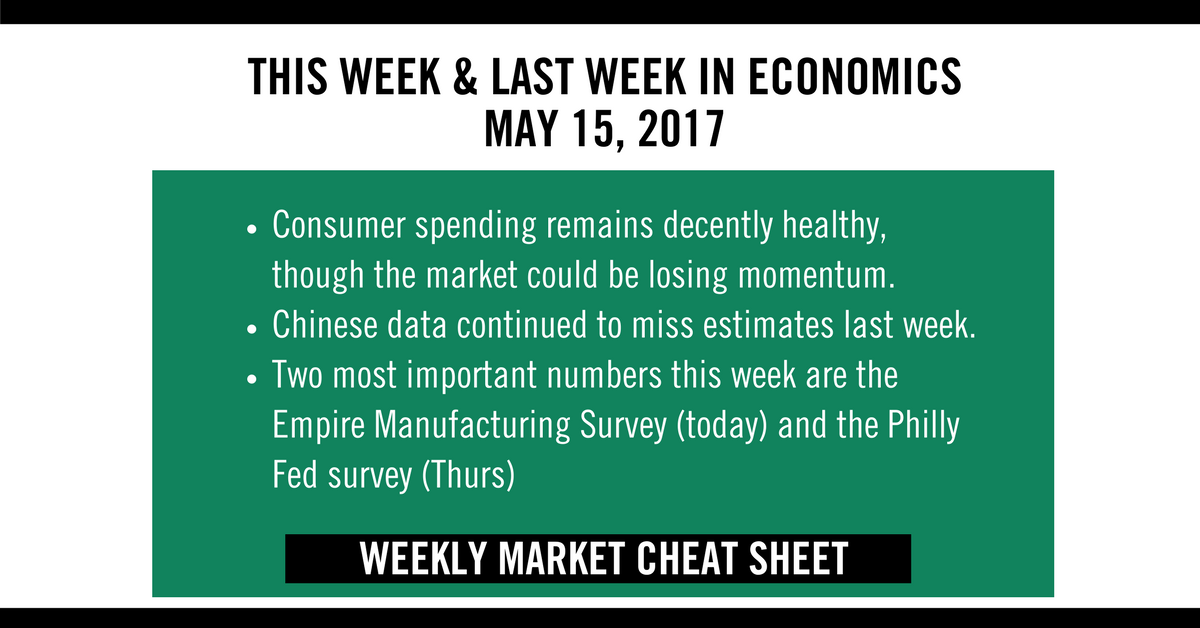

Weekly Market Cheat Sheet, May 15, 2017

/in Investing/by Tom EssayeThe Sevens Report is the daily markets cheat sheet our subscribers use to keep up on markets, leading indicators, seize opportunities, avoid risks and get more assets. Get a free two-week trial with no obligation, just tell us where to send it. Last Week in Review: Economic data last week was mixed in total, but from a […]

What Comey’s Firing Means for Markets, May 11, 2017

/in Investing/by Tom EssayeJoin hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if the Sevens Report is right for you with a free 2-week trial. Regardless of how the rest of the year turns out, I personally will always remember 2017 for the fact that I […]

Volatility—What Goes Down Must Come Up, But It Can Take a Long Time!, May 10, 2017

/in Investing/by Tom EssayeGet the simple talking points you need to strengthen your client relationships with the Sevens Report. Sign up today for your no obligation 2-week free trial. Historically low volatility is becoming a bigger topic in the markets these days, and while earlier in the year low volatility was referenced with more of an observational tone, […]

Earnings Season Post Mortem & Valuation Update, May 9, 2017

/in Investing/by Tom EssayeThe Sevens Report is everything you need to know about the market in your inbox by 7am, in 7 minutes or less. Claim your free 2-week trial. The S&P 500 has been largely “stuck” in the 2300-2400 trading range for nearly 10 weeks, despite a big non-confirmation from 10-year yields, modestly slowing economic data and political disappointment. […]

Earnings and economic growth are still solid

/in Investing, Reports/by Customer Service“Earnings and economic growth (the two most important foundational forces for stocks) are still solid,” the analysts wrote.