Sevens Report’s Tom Essaye quoted in Barron’s on December 13, 2018

/in Investing/by Customer ServiceTom Essaye quoted in Barron’s on December 13, 2018.

Sevens Report’s Tom Essaye appeared on Cheddar on December 12, 2018

/in Investing/by Customer ServiceSevens Report’s Tom Essaye appeared on Cheddar on December 12, 2018. He breaks down how Trump’s optimism on trade talks, and impacted the markets.

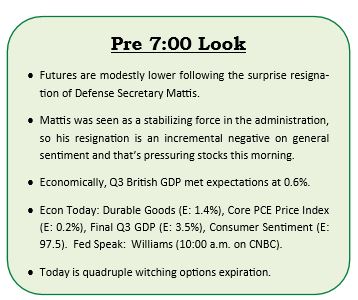

Bounce Coming?

/in Investing/by Tom EssayeWhat’s in Today’s Report: Why We Could Be Close to a Bounce Futures are modestly lower following the surprise resignation of Defense Secretary Mattis. Mattis was seen as a stabilizing force in the administration, so his resignation is an incremental negative on general sentiment and that’s pressuring stocks this morning. Economically, Q3 British GDP met […]

FOMC Takeaways (Not Good)

/in Investing/by Tom EssayeFOMC Decision Takeaways, futures are slightly higher, it was a quiet night of news as there were no new headlines on trade, today focus will remain on the economic data, which becomes even more important in the face of the not dovish enough Fed. We get to notable reports today, Jobless Claims (E: 220K) and Philadelphia Fed Business Outlook Survey (E: 16.5) and if the later misses expectations, look for more selling and more.

FOMC Preview

/in Investing/by Tom EssayeFOMC preview, US stock futures are enjoying a pre-Fed bounce this morning, despite the bounce in futures, news flows were actually bearish since yesterday’s close as both FDX and MU made cautious comments about slowing global growth in their respective earnings calls and both cut guidance for 2019, In the US today, there is one economic report due to be released: Existing Home Sales (E: 5.190M) and a “beat” would be well received after the string of soft housing data points of recent, but frankly all eyes will be on the Fed and the report will not materially move markets, and more.

Technical Update: Ugly Breaks

/in Investing/by Tom EssayeTechnical Update: ugly breaks, S&P futures are bouncing this morning but only modestly so relative to yesterday’s sizeable declines in U.S. markets which weighed broadly on global shares overnight (although the losses were not as bad as feared), Oil is notably down almost 3% as concerns have shifted from the supply side to demand side in recent weeks, there is only one economic report to watch: Housing Starts (E: 1.22M) but if it is a “whiff” like yesterday’s Housing Market Index was, which hit a multi-year low, it could keep growth concerns elevated and prevent a material relief rally and more.

Trade War 2.0 Primer (Needed Context)

/in Investing, Reports/by Tom EssayeWhat’s in Today’s Report: U.S. Trade Primer (Needed Context for Trade War 2.0)