Technical Update (Bounce or Bottom?)

/in Investing/by Tom EssayeTechnical Market Update – Bounce or Bottom?, U.S./China Trade Update (What’s Next and What Sectors Benefit), Futures are modestly lower as markets digest the recent rally following a quiet night of news. Today focus will remain on the Fed as we get multiple Fed speakers, highlighted by Fed Chair Powell (1:00 PM) and Vice Chair Clarida (5:30 PM) and more.

January Economic Breaker Panel Update

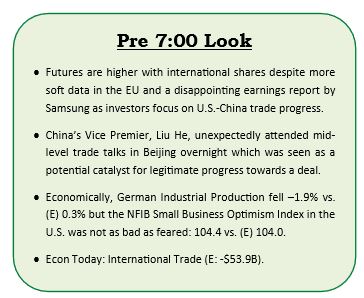

/in Investing/by Tom EssayeSome improvement in the Economic Breaker Panel: Three breakers tripped, January update, futures are cautiously higher this morning mostly thanks to optimism about the US-China trade situation as “mid-level” meetings concluded in Beijing overnight, President Trump’s address to the nation last night regarding border security and the government shutdown did not have a material effect on markets and more.

Encouraging Signs from Credit

/in Investing/by Tom EssayeSome encouraging signs from credit, futures are higher with international shares, today, there is one economic report to watch: International Trade (E: -$53.9B) which has been more closely watched since U.S.-China trade tensions first escalated while there are no Fed officials scheduled to speak and more.

Four Keys to a Market Bottom Updated

/in Investing/by Tom EssayeWhat’s in Today’s Report: Four Keys to a Market Bottom – More Progress But Not There Yet Weekly Market Preview Weekly Economic Cheat Sheet Futures are marginally lower following a quiet weekend as markets digest Friday’s big rally. Economic data was mixed overnight as Japanese Composite PMI and German Manufacturers’ Orders missed estimates. However, German […]

How Bad Can It Get? Valuation Worst Case Scenario

/in Investing/by Tom EssayeHow bad can it get? Valuation worst case scenario, futures are sharply higher after China took further steps to support the economy while economic data was mixed, China announced a 1% cut to bank reserve requirements requirements and pledged to do more to support the economy and more.

Sevens Report’s Tyler Richey quoted in MarketWatch on January 3, 2019

/in Investing/by Customer ServiceSevens Report’s Tyler Richey quoted in MarketWatch on January 3, 2019.

Year-end positioning and lackluster trading volumes

/in Investing, Reports/by Customer ServiceSevens Report President Tom Essaye believes year-end positioning and lackluster trading volumes—issues that will ease after New Year’s—are the real culprits behind the declines.