How Brexit Will Move Markets (Stocks, Bonds & the Dollar)

Many subscribers to the Sevens Report have been asking:

- What Will Make Brexit Good, Bad and Ugly

- Why a “Remain” Vote May Not Be A Positive for Stocks

- How Stocks, Bonds and the Dollar Will React Depending on the Vote

- How to Protect Portfolios and Seize Opportunities Regardless of the Outcome.

Brexit Preview: Good, Bad & Ugly

First, let me start by saying that any remain win will result in a relief rally, one that likely will take European stocks through the pre-Brexit highs of late May, and the S&P 500 through 2,100 to test recent resistance at 2,120. But for Brexit to become a material positive (and in that regard be totally removed as a macro headwind), style points will matter with regards to “by how much” the remain camp wins.

Conversely, the size of a leave victory is unimportant. Whether Great Britain votes to leave by a one-vote majority or a 10% majority, the result in markets will be the same—pain!

The Good: Remain Wins by > 10%. This is the best outcome for the bulls. The reason for that is because a greater-than-10% victory likely means that, at least for the foreseeable future, the idea of Brexit politically will be dead—and that means we don’t have to worry about another vote in the future.

Likely Market Outcome: Risk On. Stocks: Sharply higher and led by Europe, although the US will be up big also. Resistance at 2,120 will likely be tested in the S&P 500. Sector Winners: Anything with UK or European exposure will outperform (and the more the better, HEDJ and VGK are obvious winners), US global industrials like GE/HON will also benefit from the reduced international uncertainty. Financials (XLF), banks (KBE) and basic materials also will outperform (thanks to a weaker dollar and rising bond yields). Bonds: Treasuries and bunds will drop (likely sharply) and yields will rise (likely sharply). Commodities and Currencies: Gold will drop (support at $1,250 will be important) while industrial commodities will rally (oil, copper, etc.). The dollar and yen will get hit, likely hard, and support at 93.50 in the dollar will likely be broken on a short-term basis, but as long as there isn’t a close below 92.52 it’s not too bearish. Finally, the pound and euro will surge short term (although we don’t see this outcome as starting a new material move lower in the dollar or move higher in European currencies beyond the short term).

The “Bad”: Remain Wins By <10%. I put “bad” in quotation marks because risk assets will still rally on this outcome, but the market reaction should be substantially muted compared to the “Good” scenario. Here’s why.

If remain wins by a slim margin, we will likely have another Brexit vote, potentially in late 2016 or early 2017. The reason for that is politics: If the remain win is tight, the ruling Conservative party’s mandate will be called into question and a general election will likely be called later this year. The minority parties (Labour and others) will use another potential Brexit vote as a carrot to try and seize power in that general election.

Bottom line, if this victory is slim, Brexit will be put on the back burner from a macro risk standpoint, but it won’t be removed.

Likely Market Reaction: Basically a scaled-down version of the “Good” outcome, with moves in the same direction, just in smaller percentages.

The Ugly: Leave Wins. If leave wins by just a single vote it will be a material negative for Europe and Great Britain (at least for the short and medium term).

Likely Market Reaction: Risk Off. Stocks: Europe would drop like a stone (3%-5% is not out of the question). US stocks would also drop (2,050 would be important support for the S&P 500). Sector losers: Banks, financials, global industrials and basic materials will drop sharply. Bonds: Treasuries and bunds would surge, and I would expect the respective low yields for the year in each to be taken out on a leave outcome. Commodities and Currencies: It would be typical risk-off trading: The dollar and yen will surge, the euro and pound (and to a lessor extend commodity currencies) will drop sharply. In the dollar, resistance at 95.50 and 95.90 would likely be tested in the coming days. Looking at commodities, gold would rally big (another break of $1,300 would be likely) while oil and copper would drop sharply.

Bottom Line

From an opportunity standpoint, I’ve never been a fan of guessing binary events with which I have no special insight or edge, so tomorrow we will not be positioning ahead of the result Thursday night. I will leave that adventure to those much smarter and more intrepid than I.

But, from a broad, macro-allocation standpoint, unless we get a shock and leave wins, this won’t change my opinion on US stocks broadly. I have looked at Brexit largely as a mid-summer distraction, and I hope to be proven right on that by this time tomorrow. Beyond potentially creating a buying opportunity for HEDJ (as we mentioned last week) or a Great Britain ETF, the only other likely legitimate market reaction from this will be a move lower in Treasuries and bunds (i.e. higher yields).

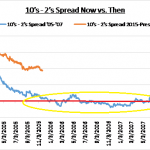

To that point, if remain wins and we do not see a material move in Treasury and bund yields over the coming week or two, I will take that as a big negative signal on the economy and markets—because absent Brexit protection buying, those yields should be substantially higher than they are, if we are to believe the economic data.

And while the S&P 500 will likely surge on a remain victory, nothing about it will make us more inclined to get bullish on stocks, because the issues of 1) valuation, 2) lackluster economic growth, 3) troubling profit margin trends in corporate America and 4) lack of Fed clarity will “remain” (pardon the pun).