What’s in Today’s Report:

- What the Fed Decision Means for Markets

- FOMC Decision Takeaways

- Oil Update – Resilient Demand Offset By Fed Policy Worries

U.S. equity futures are lower as the Fed decision continues to be digested while global economic data largely missed expectations overnight.

Economically, Chinese data was universally disappointing with Industrial Production and Retail Sales both missing estimates while EU trade data showed that imports and exports both declined by more than anticipated. China’s central bank cut rates further overnight, however, which saw risk assets in Asia recover to end with gains.

Looking into today’s session, the ECB decision will be in focus this morning (E: +25bp hike) followed by President Lagarde’s press conference. If the ECB is seen as hawkish, it will likely weigh on stocks and other risk assets as it will show central bankers are not yet satisfied with the trends in inflation and more aggressive policy is likely in the months ahead.

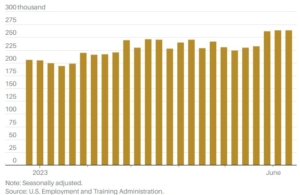

In the U.S., there is a slew of economic data due to be released including: Jobless Claims (E: 250K), Retail Sales (E: 0.0%), Philadelphia Fed Manufacturing Index (E: -13.2), Empire State Manufacturing Index (E: -15.1), Import & Export Prices (E: -0.6%, -0.5%), and Industrial Production (E: 0.1%).

And with the Fed leaving future policy plans largely “open” and dependent on economic data, the market will want to see more “Goldilocks” trends with slowing growth and a more rapid decline in price readings.

Sevens Report Alpha: Artificial Intelligence Issue

This week’s Alpha issue focused on a very popular market topic: Artificial Intelligence.

This issue was an update to a March 7th Alpha issue on AI, and the three ETFs we profiled in that report have risen 20%, 17%, and 14%, respectively in just three months!

This week’s AI issue updated and expanded that research as we:

- Reviewed and updated the research on our previous AI ETF picks.

- Introduced two new AI-focused ETFs that are both up more than 30% YTD.

- Included a proprietary spreadsheet of 30 AI stocks and categorized them by: Sector, Market Cap, Price/Earnings ratio, Price/Sales ratio, Revenue, and Performance.

If you’d like to start a risk-free trial subscription to Sevens Report Alpha and access the latest AI issue, and all previous Alpha issues and webinars since 2017, please email info@sevensreport.com.

We do ask that you pay the $330 quarterly subscription fee, but there is a 30 day money back guarantee, so you risk nothing to try the product.

To learn more about Sevens Report Alpha, click this link.