What’s in Today’s Report:

- Three Events That Would Make This Pullback Worse

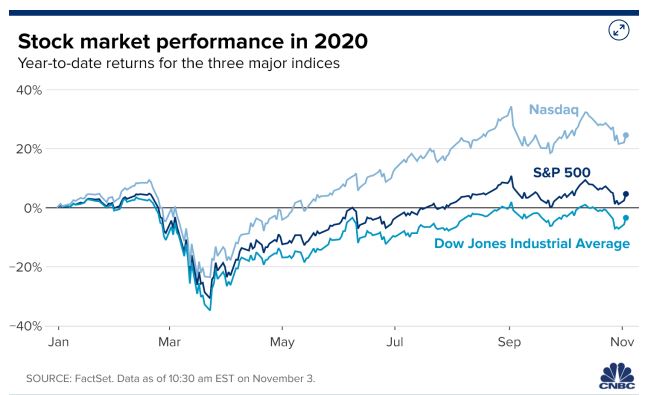

- The One Underlying Reason for the Decline Yesterday

Futures are bouncing modestly from Wednesday’s drop following a generally quiet night.

There was no new coronavirus related news overnight as infection numbers continue to rise in Europe and the U.S.

Politically, polls are tightening but the market still expects a Biden victory, while the Senate remains a toss-up.

Today will be a busy day as it is the most important day of Q3 earnings, and we also get important economic reports.

First, on the earnings front, several of the most important tech stocks for the entire market report after the close, including: AMZN ($7.30), AAPL ($0.69), FB ($1.94), GOOGL ($11.39), TWTR ($0.06).

Also this morning, we get two potentially important economic and central bank events. First, weekly jobless claims need to hold last week’s gains (and stay under or close to 800k, which would reassure market the recovery is still ongoing). Second, the ECB decision is this morning, and no change is expected to policy. But, during the press conference, which starts at 8:45 a.m., markets will want to see ECB President Lagarde strongly hint more easing coming soon.

Finally, the financial media will likely highlight the Preliminary Q3 GDP which will likely set a record at 30.9%. But, that number won’t move markets. First, Q2 GDP fell by 31% (also a record), so that’s important context. Second, it’s an “stale” number and the market is only interested in current looks at the economy, which is why weekly claims are the more important economic reading this morning.