What’s in Today’s Report:

- Is There a Commodity Supercycle in the Works?

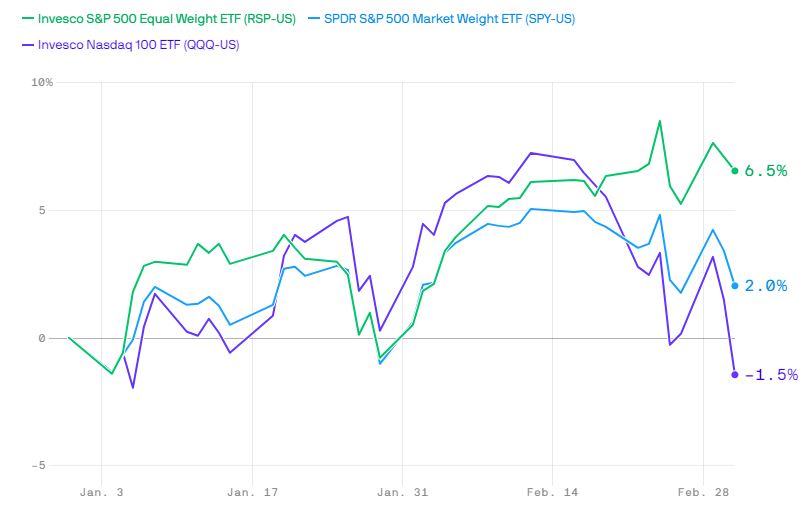

- Value vs. Growth Update

U.S. equity futures are rallying with most global markets this morning as economic data mostly topped estimates overnight while there is a renewed sense of stimulus optimism as the $1.9T relief bill moves to the Senate today. President Biden also said that vaccine supplies will be sufficient to vaccinate all U.S. adults by the end of May, earlier than previously thought, which is offering further support to risk assets this morning.

Final Composite PMI data from February was largely upbeat with the Eurozone figure jumping to 48.8 vs. (E) 48.1, which helped offset a slight monthly dip in the Chinese headline.

Today is lining up to be a fairly busy day from a catalyst standpoint as there are two notable economic reports to watch: ADP Employment Report (E: 165K) and ISM Services Index (E: 58.7), both of which have the potential to move markets.

There are multiple Fed speakers to watch today: Harker (10:00 a.m. ET), Bostic (12:00 p.m. ET), Evans (1:00 p.m. ET), and Kaplan (6:05 p.m. ET), while markets will also be following any developments regarding the stimulus bill as it moves to the Senate today.

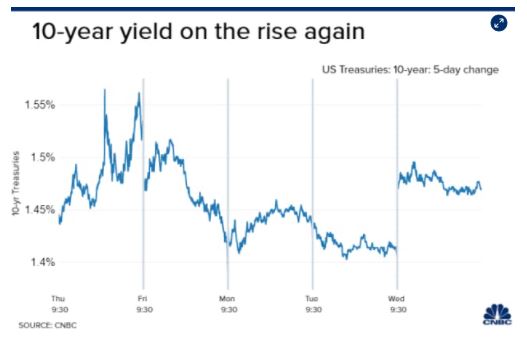

As long as economic data does not indicate a significant slowdown in the pace of the recovery, Fed speak remains very dovish, the legislative process with the stimulus bill remains smooth, and potentially most importantly, the bond market continues to trade in an orderly fashion, then stocks should be able to hold this week’s rebound. However if there are negative surprises regarding any of those market influences Monday’s sizeable gains could be given back in a hurry.