What Friday’s Jobs Report Means for Markets

What’s in Today’s Report:

- What Friday’s Job Report Means for the Rally (Less Dovish Fed?)

- Weekly Market Preview: Infrastructure Progress and Fed Outlook

- Weekly Economic Cheat Sheet: Is a Spike in Inflation Coming?

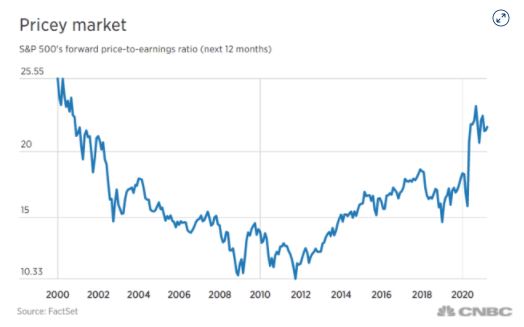

Futures are modestly higher on momentum from Friday’s strong (but not too strong) jobs report.

Friday’s jobs report handily beat estimates (916k vs. (E) 660k) but the unemployment rate remained above 6% and wages were soft, so the number didn’t spike Treasury yields and futures rose Friday after the release.

There was no notable economic data or political news over the weekend and many foreign markets are closed for Easter Monday.

Today the key economic report is the ISM Services PMI (E: 58.6) and markets will want to see a strong number showing a continued rebound in the service sector. With many foreign markets closed, trading should be otherwise quiet but the 10 year yield is still key. It digested Friday’s strong jobs report well, but if we see a rally today towards 1.80%, that will be a headwind on stocks.