What’s in Today’s Report:

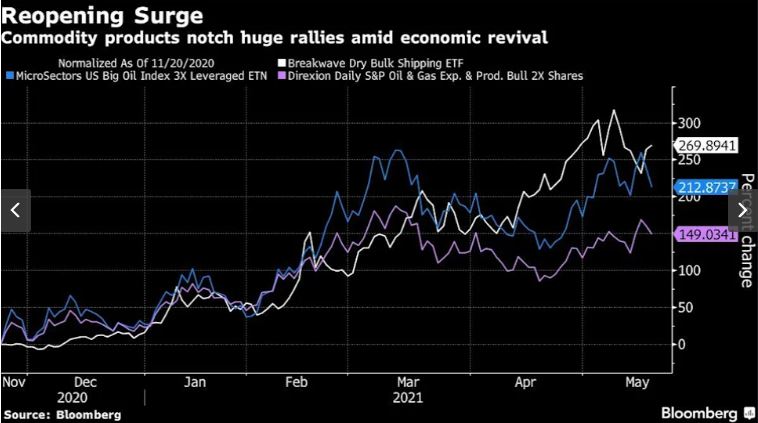

- Economic Breaker Panel – May Update

- Empire State Manufacturing Survey Takeaways (Price Index Charts)

Futures are trading modestly higher in sympathy with global shares which rallied on rising re-opening bets overnight while economic data came in largely as expected.

Economically, Japanese and Eurozone GDP data as well as the U.K. Labour Market Report all printed largely in-line with estimates o/n and did not materially move markets.

Today, there is one economic report: Housing Starts (E: 1.715M) but it should not have a major impact on markets while the Treasury will hold a 52-Week Treasury Bill auction at 11:30 a.m. ET (these shorter duration auctions will become increasingly important as investors gauge the market’s taper/tightening expectations).

Turning to Fed, there are two speakers to watch today: Bostic (11:00 a.m. & 12:30 p.m. ET) and Kaplan (11:05 a.m. ET).

You can receive the Sevens Report for free, click here to take advantage of this offer.