What’s in Today’s Report:

- What to Make of Yesterday’s Selloff and Reversal

- FOMC Preview

- Chart: S&P 500 Measured Move Reached

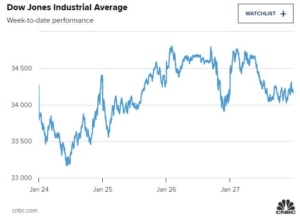

Futures are trading off of the overnight lows but still down roughly 1% as yesterday’s volatile session is digested ahead of the Fed while IBM posted strong Q4 earnings yesterday and economic data largely met estimates overnight.

The FOMC meeting begins today which will increasingly capture trader focus ahead of tomorrow’s announcement and press conference.

Economically, we get two reports on the housing market this morning: the Case-Shiller Home Price Index (E: 1.0%) and the FHFA House Price Index (E: 1.0%) but Consumer Confidence (E: 111.9) will be the more important number to watch given the growing uncertainty about the state of the economic recovery. Another bad print like we saw with yesterday’s Composite PMI Flash could send stocks lower.

There is a 5-Yr Treasury Note auction at 1:00 p.m. ET and investors will be looking for strong demand (which would reflect dovish shifting Fed expectations) as we saw with yesterday’s 2-Yr auction which helped stocks bottom and reversed so sharply in intraday trade.

Finally, on the earnings front, we will hear from: JNJ ($2.12), VZ ($1.28), GE ($0.83), MMM ($2.03), and AXP ($1.78) before the open, and then MSFT ($2.29), TXN ($1.95), and COF ($5.14) after the close.