What’s in Today’s Report:

- Technical Update – Bearish Price Patterns and Dow Theory Threatens to Turn Bearish

Futures are modestly lower this morning after a quiet night of news as yesterday’s big intraday reversal higher is being digested.

Today is lining up to be a busy one with a slew of economic data due to be released, in order of importance: Durable Goods (E: 1.0%), Consumer Confidence (E: 106.8), Case-Shiller Home Price Index (E: 1.5%), FHFA House Price Index (E: 1.6%), and New Home Sales (E: 772K). Investors will want to see solid data that contradicts the growing fear that the Fed is getting more aggressive with policy into an economic slowdown.

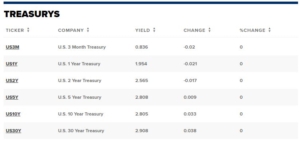

There are no Fed speakers today but there is a 2-Yr Treasury Note auction at 1:00 p.m. ET that could move the bond market and ultimately impact stocks in the early afternoon.

The market’s main focus today will be on earnings with: UPS ($2.87), PEP ($1.24), GE ($0.20), MMM ($2.33), and JBLU (-$0.85) reporting ahead of the bell while MSFT ($2.18), GOOGL ($25.63), GM ($1.57), V ($1.65), and COF ($5.39) are all scheduled to release results after the close.

Bottom line, for yesterday’s late day reversal higher in equity markets to continue today, we need to see good economic data, steady or falling bond yields, and most importantly favorable earnings, especially out of big tech names like GOOGL and MSFT.