Good, Bad, & Ugly Market Scenarios

What’s in Today’s Report:

- Good/Bad/Ugly Scenarios: Likely Market Reactions (Print this Table)

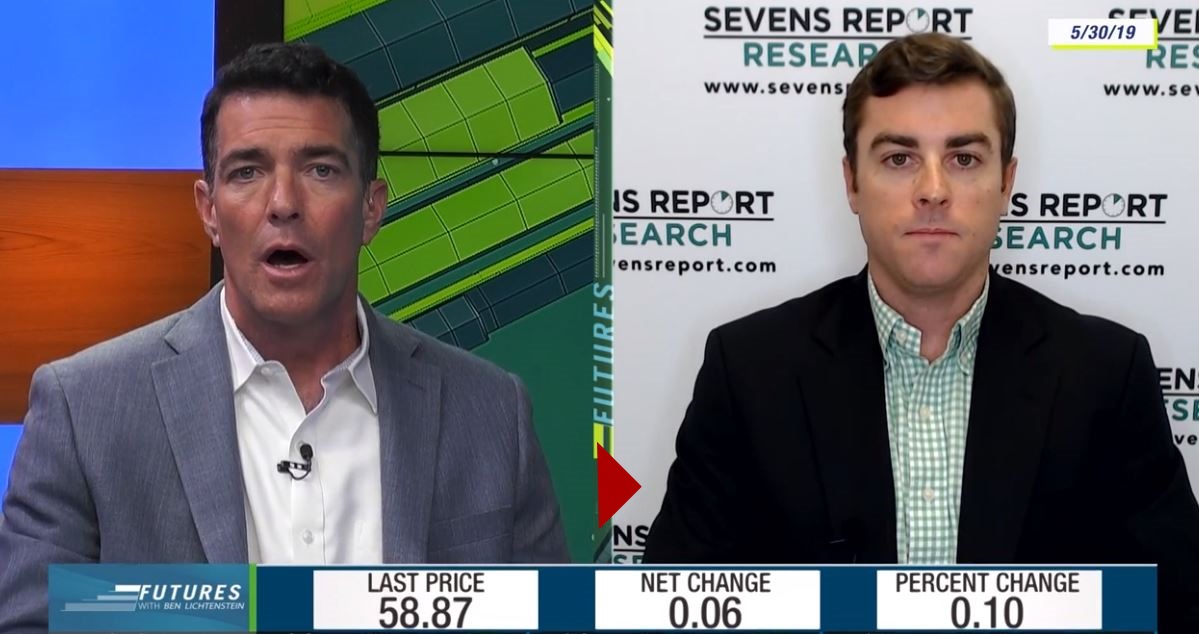

Stock futures are bouncing modestly as investor sentiment improved o/n amid reported progress on one front of the trade war while the markets await Fed comments today.

There were two positive headlines on U.S.-Mexico trade overnight.

First, Republicans in Congress are working to block Trump’s tariff plans and second, the Mexican government has already stepped up border security, showing cooperation on the main demands from the White House.

Meanwhile the RBA cut rates as expected, but the move is adding to the dovish tailwind that has helped markets stabilize so far this week.

Today, there are a few data points to watch: Motor Vehicle Sales (E: 16.9M) and Factory Orders (E: -0.8%), but the markets main focus will be on the Fed as there are several speakers: Williams (8:30 a.m. ET), Powell (9:55 a.m. ET), Brainard (3:45 p.m. ET).

Powell will clearly be the most closely watched, however any further hints at a potential rate cut in the near term will be received positively by the market. Conversely if Bullard’s dovish comments from yesterday are contradicted, stocks could easily turn back negative on the week.