What’s in Today’s Report:

- Why Collapsing Bond Yields Are Boosting Stocks (For Now)

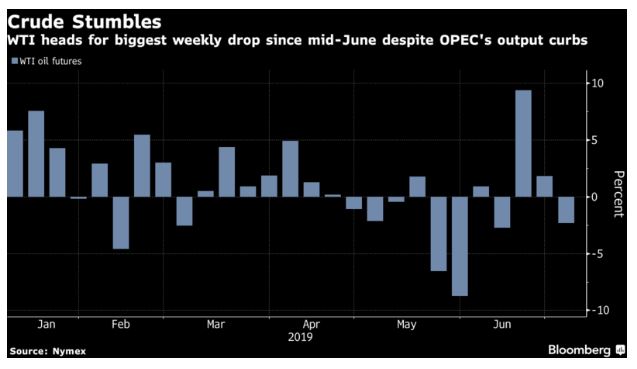

- Oil Market Update/EIA Analysis

Futures are marginally lower as markets digest Wednesday’s new highs ahead of the jobs report.

Trading Thursday was quiet globally as there was no notable news, and most foreign indices were little changed.

Economic data continued to disappoint, as German Factory Orders became the latest manufacturing reading to badly miss estimates (-2.2% vs. (E) 0.2%).

Today focus will be on the Employment Situation Report and estimates are as follows: Jobs (E): 165k, Unemployment Rate (E): 3.6%, Wages (E): 3.2%. As we saw on Wednesday (and really all week) slightly disappointing or better than expected data will likely result in the S&P 500 trading above 3000, while a very strong or very weak number will likely hit stocks.

For now, markets are convinced collapsing global bond yields are just reflective of impending dovish central bank policies, and until data gets bad enough to cause worries about the economy, those lower yields will be a short term tailwind on stocks (but longer term problem, according to history).