Market Multiple Update

What’s in Today’s Report:

- U.S.-Iran Update

- Market Multiple Update: Initial 2020 Edition

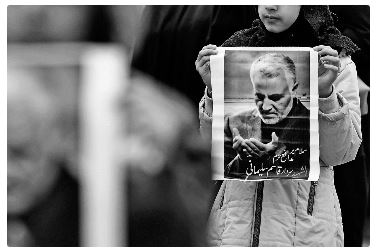

Global stocks plunged overnight on reports of an Iranian missile strike against U.S. military bases in Iraq. Risk assets have since recovered however as there were no U.S. casualties reported and Iran said the attacks “concluded” Tehran’s retaliation for the assassination of General Soleimani.

In Europe, German Manufacturers’ Orders were –1.3% vs. (E) 0.2% but the easing geopolitical tensions between the U.S. and Iran are supporting modest gains in EU markets.

Looking into today’s session, geopolitics will likely dominate trading but as long as tensions continue to ease between the U.S. and Iran, stocks will likely be able to trade with an upside bias.

As far as other catalysts go, there is one economic report to watch: ADP Employment Report (E: 157K), one Fed official scheduled to speak: Brainard (10:00 a.m. ET) and a 10-Yr T-Note Auction at 1:00 p.m. ET.