Market Multiple Levels: S&P 500 Chart

What’s in Today’s Report:

- Market Multiple Levels: S&P 500 Chart

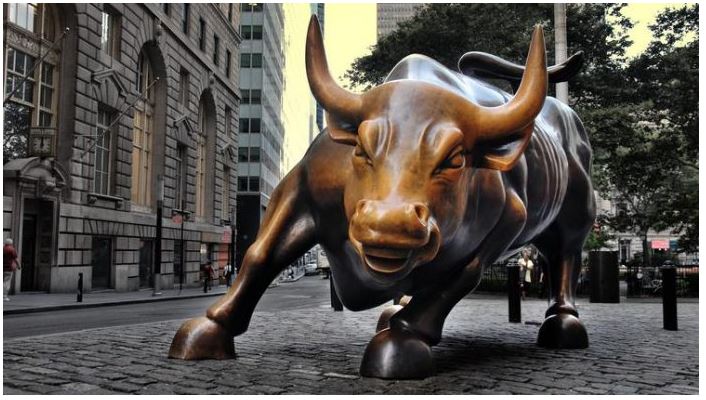

- Growth vs. Value: A Lower-Risk Way to Play the RotationU.S. equity futures are trading comfortably higher this morning as vaccine optimism continues to offset a resurgence in the COVID-19 pandemic and big cap tech stocks are showing signs of stabilizing in pre-market trade.

Daily new cases of the coronavirus hit a new high of over 135,000 in the U.S. yesterday while hospitalizations also hit record levels however investors continue to hold out hope that a vaccine will halt the spread in the coming months and the economy will be quick to normalize.

There are no economic reports today and no Fed officials are scheduled to speak which will leave investors focused on the timeline for the widespread availability of a vaccine and more importantly how quickly it will result in economic normalization.

The election remains a secondary influence on the market as well with Biden having declared victory over the weekend while Trump continues to file lawsuits in swing states about alleged voter fraud. Any further clarity or resolution on the election should act as a tailwind for markets in the near term as it will pull forward the timeline for the next coronavirus aid package.