Why the Bounce Can Continue (But Volatility Isn’t Over)

What’s in Today’s Report:

- Why Stocks Can Bounce Further (But Volatility Isn’t Over)

- Technical Update: Important Support and Resistance Levels to Watch

- Weekly Economic Cheat Sheet: Jobs Report Friday

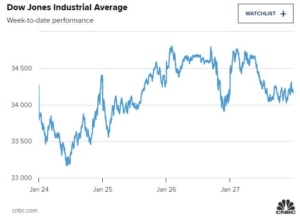

Futures are slightly lower following a quiet weekend as markets digested last week’s volatility and Friday’s rally.

Atlanta Fed President Bostic was encouraged by Friday’s inflation data and expected three hikes this year, which is less hawkish than the current market expectation.

China’s manufacturing PMI slightly best estimates at 51.1 vs. (E) 51.0, further implying that economy is stabilizing.

There are no economic reports today, but there are two Fed speakers, Daly (11:30 a.m. ET) and George (12:40 p.m. ET) and if they echo Bostic’s “not as hawkish as expected” commentary from this weekend, then stocks can extend the rally.

On the earnings front, most of the big reports come later this week (FB, GOOGL, AMZN) but after the close today, we get NXPI ($2.98) and markets will be focused on chip availability, and if there’s positive commentary there that could be another tailwind on this market.