What’s in Today’s Report:

- It’s All About Escalation (And What Can Go Wrong)

- ISM Manufacturing Report Takeaways

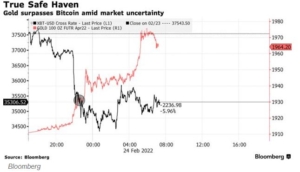

Stock futures recovered from overnight losses as investors digest President Biden’s State of the Union speech, and a slight de-escalation in the Russia-Ukraine conflict.

Geopolitically, President Biden announced that the U.S. would close its airspace to Russian planes during the open of his State of the Union address, however overnight, Russia expressed willingness to resume talks with Ukrainian leadership today and that is raising hopes for a ceasefire deal, fueling moderate risk-on money flows.

Economically, the Eurozone HICP Flash was hot with the headline jumping to 5.8% vs. (E) 5.3% which is adding to angst about stagflation.

Today, there are a few data points to watch including: Motor Vehicle Sales (E: 14.6M) and the first look at official February jobs data in the form of the ADP Employment Report (E: 320K).

Additionally, there are two Fed speakers around the time of the open: Evans (9:00 a.m. ET) and Bullard (9:30 a.m. ET) before Fed Chair Powell will begin his semi-annual Congressional testimony at 10:00 a.m. ET.

Bottom line, the Russia-Ukraine conflict will continue to dominate the headlines and markets today, and any de-escalation could trigger a further relief rally. However, investors will be watching Powell closely for any signs of a change in policy which could also impact markets.