CPI Day and FOMC Preview

What’s in Today’s Report:

- FOMC Preview

- CPI Preview (Abbreviated Version)

- Chart – NY Fed Survey Inflation Expectations Fall Sharply

Stock futures are extending yesterday’s gains as traders await today’s CPI report amid mixed news from overnight.

In China, a $143B stimulus package aimed at the semiconductor industry helped offset the delay of an economic/Covid policy meeting due to a surge in Covid cases.

Economic data was mixed overnight but there were no surprises material enough to derail the tentative pre-CPI rally this morning.

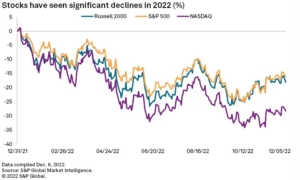

Today, traders will be keenly focused on the November CPI report at 8:30 a.m. ET with the headline expected to come in at 0.3% M/M and 7.3% Y/Y while the Core figure is expected to be 0.4% M/M and 6.1% Y/Y. Bottom line, a print below 7.3% on the headline and below 6.1% in the core figure will be well received by investors but an upside miss in either could trigger a sharp reversal of this most recent move higher in the broader stock market.

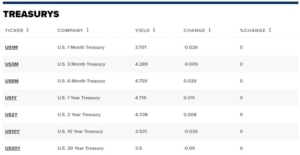

Once markets digest the CPI report, money flows are likely to take on a positioning tone with tomorrow’s Fed decision looming and a limited list of catalysts for the remainder of the day. There is a 30-Yr Treasury Bond auction at 1:00 p.m. ET that could move rates and have a mild impact on stocks.