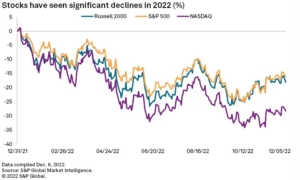

A Make of Break Week for Stocks and Bonds

What’s in Today’s Report:

- A Make or Break Week for Stocks and Bonds

- CPI Preview: Good, Bad & Ugly

- Weekly Market Preview: Year-End Rally?

- Weekly Economic Cheat Sheet: Fed Decision Wednesday and CPI Tomorrow are the key events.

Futures are slightly higher as China continues to remove COVID restrictions. The rest of the weekend was quiet from a macroeconomic perspective.

China announced it will deactivate its COVID tracking app in the latest signal that it is gradually abandoning the “Zero COVID” policy.

Economically, reports were sparse but UK Industrial Production (0.7% vs. (E) 0.0%) and Monthly GDP (0.5% vs. (E) 0.4%) both beat expectations.

Today the economic calendar is quiet and trading should be also, as markets look ahead to the week’s key events tomorrow (CPI) and Wednesday (FOMC Decision).

Annual Discounts on Sevens Report, Alpha, and Quarterly Letter

We’ve recently been contacted by advisor subscribers who wanted to use the remainder of their 2022 pre-tax research budgets to extend their current subscriptions, upgrade to an annual (and get a month free), or add a new product (Alpha or Quarterly Letter).

If you have unused pre-tax research dollars, we offer month-free discounts on all our products. If you want to extend current subscriptions or save money by upgrading to an annual subscription (across any Sevens Report product), please email info@sevensreport.com.