Bond Bubble

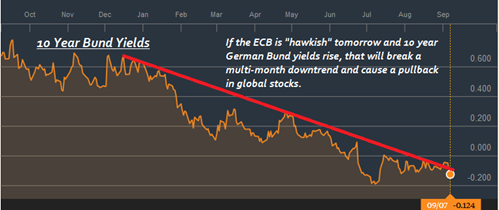

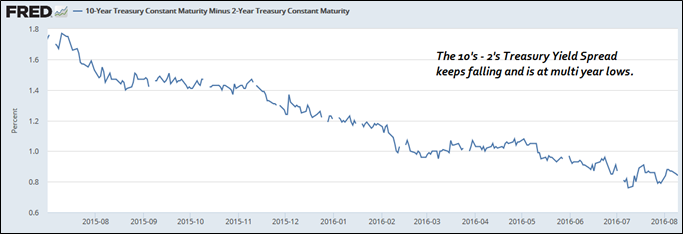

Something potentially very important just happened with the 10-year Treasury yield.

It broke a downtrend in place since the start of 2016, and if it can hold this breakout through the Bank of Japan and Fed meeting next week, it will be a strong signal that the bond bull market may be ending, and interest rates may be (finally) moving higher.

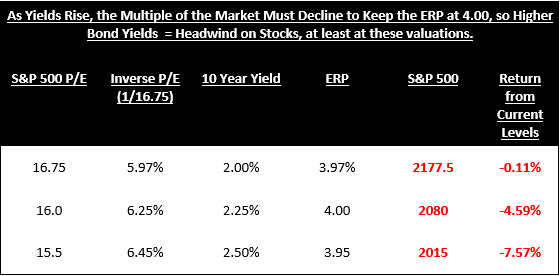

I’m under no illusions that bonds aren’t exactly the most exciting topic in the markets, but the reason we keep focusing on the action in the bond markets is because what bond yields do from here will

be critically important for how stocks and bonds perform in Q4.

Stocks have pulled back a bit recently as bond yields have risen, but the potential is still there for either a continued melt up (at which point advisors are going to want to be very long) or a potentially violent pullback in both stocks and bonds (at which point advisors are going to want to be very defensive).

So, with the BOJ and Fed meeting looming next week and the first presidential debate the week after that, the rest of September will be an especially critical time if you are an advisor or investor who has underperformed markets so far in 2016 (and there are a lot of very good advisors who have underperformed this difficult market), as these events will present an opportunity to close that performance gap… if you know what’s happening and how to be positioned.

And, we’ve seen that over the past few weeks. Banks and other “higher-rate sensitive” sectors have massively outperformed, while tech and higher beta allocations have lagged, rewarding cautious advisors and investors who didn’t chase markets higher in late July/August.

We are going to be very focused on making sure our paid subscribers know, immediately, what the implications are for each of these key events,

and which sectors will benefit from those events, whether it’s banks, consumer staples, utilities, tech or inverse ETFs.

In tomorrow’s edition of The Sevens Report

we are going to be providing a “Higher Rate Playbook” for paid subscribers that details (with specific ETFs):

1) How to hedge a higher interest rate driven decline in stocks,

2) Which market sectors will outperform in a higher rate environment, and

3) What parts of the bond market will outperform and underperform in a rising rate environment.

Look, it’s been a very tough year to beat lazy indexing, but we recognize the chance to make up ground over the coming weeks, and into Q4 and we’re going to be focused on helping our advisor subscribers do just that by making sure they have the need-to-know analysis of all asset classes and global regions, not just US economics or the Fed.

We’re approaching the one-year anniversary of the August 2015 collapse in stocks, and while markets are higher (finally), so is volatility, as international events exert greater influence over the Fed, the US economy, and the US stock market.

We understand that in this market, clients’ assets are at the mercy of the BOJ, ECB, Italian banks, Chinese policy makers, etc., and that’s why, every day, we make sure our paid subscribers know the key trends in:

- Stocks

- Bonds

- Commodities

- Currencies

- Economic data

It’s only by providing that 360-degree coverage, every day, that advisors and investors can truly have an understanding of the risks and opportunities for their portfolios in this environment.

The end of the bond bull market has been called many times by analysts over the past several years, and while I’m not about to do that today (the benefit of the doubt remains with the bulls) there is a subtle but important change in the markets that may signal the lows in Treasury yields are in for a long, long time.

Another Nail in the Bond Bubble Coffin?

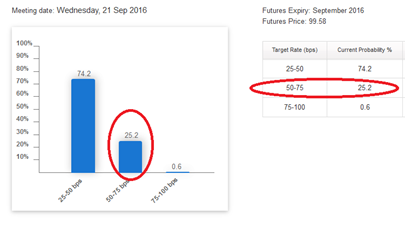

Hopefully by now we’ve driven home the point that next week’s BOJ meeting is the most important event on the calendar since Brexit, because if the BOJ disappoints markets it’ll send Japanese bond yields higher, which will pull Treasury yields higher and hurt stocks.

But, even if the BOJ chooses to do more stimulus, we still may have seen the lows in global bond yields for a very long time.

The reason?

Currency hedging (and Las Vegas).

Longer-term readers know that foreign buying of Treasuries has been a massively positive influence on Treasury prices/negative influence on yields.

One of the reasons foreign buyers have gobbled up Treasuries over the past several years was because it was very easy and cheap to hedge out the currency exposure (a German portfolio manager who bought Treasuries was also buying dollars, and that represented an additional risk he or she would want to hedge out, so it became a pure yield play).

But too much of a good thing can become a problem, and in this case the ocean of foreign money flowing into Treasuries, all looking for the same currency hedge, has caused a problem.

For those who follow sports, it’s the same problem bookies have each week when betting the spreads.

In Las Vegas, when too much money goes towards one team, bookies have to adjust the point spread to make a bet on the other team more attractive.

That’s why betting spreads move during the week, as the bookies are always trying to make the amount bet on Team A equal to the amount bet on Team B. That way the bookies have no risk and just collect fees. It’s similar with currency dealers and trading desks.

To bring it back to the markets, if everyone wanted to hedge out the risk of the euro or yen strengthening vs. their Treasury positions, the bets become too one sided and the currency dealers and trading desks have to increase their fees to insulate themselves against losses.

That has been occurring in the foreign exchange markets over the past several months, and at this point, according to reports from Deutsche Bank and Reuters (and I’ve read similar articles from other firms), it now costs so much to hedge out that foreign exchange risk that it has totally offset the additional yield you get in Treasuries over other government debt.

Basically, the “Long Treasuries” trade has become too crowded, and isn’t worth it anymore.

That’s important for advisors and their clients for one simple reason:

It means that a major source of demand for Treasuries has been diminished, which is Treasury negative regardless of what the Fed or BOJ does next week.

Have a Plan in Place if Stocks and Bonds Drop

Let me be clear: If the BOJ disappoints markets next week, both stocks and bonds will drop. But, even if the BOJ does unleash more stimulus, depending on what happens with global bond yields, we still could see Treasury yields rise (or at least not fall very much).

We are committed to making sure our paid subscribers have a strategy to protect client portfolios in either environment, and that’s why tomorrow, we are going to be providing a “Higher Rate Playbook” for them that details (with specific ETFs):

1) How to hedge a higher interest rate driven decline in stocks,

2) Which market sectors will outperform in a higher rate environment, and

3) What parts of the bond market will outperform and underperform in a rising rate environment.

If all we do is help you navigate the next six weeks correctly and help you get properly positioned in client accounts for the fourth quarter, we will have more than covered our subscription cost.

If you don’t have a morning report that is going to give you the plain-spoken, practical analysis that will help you navigate the coming weeks and help you get positioned properly to outperform into year end, then please consider a quarterly subscription to The Sevens Report.

There is no penalty to cancel, no long-term commitment, and it costs less per month than one client lunch!

With thousands of advisor subscribers from virtually every firm on Wall Street and a 90% initial retention rate, we are very confident we offer the best value in the private research market.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Value Add Research That Can Help You Finish 2016 Strong!

Our subscribers have told us how our focus on medium-term, tactical opportunities and risks has helped them outperform for clients and grow their businesses.

We continue to get strong feedback that our report is: Providing value, helping our clients outperform markets, and helping them build their books:

“Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!” – Top Producing FA from a National Brokerage Firm.

“Let me know if there is anything else that you need from us. Thanks again for everything. I really enjoy the Report – it is helping me grow my business and stay on top of things.”

– Independent FA.

“Great service from a great company!!” – FA from a National Brokerage Firm.

“Great report. You’ve become invaluable to me, thanks for everything…! – FA from a Boutique Investment Management Firm.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The Sevens Report right now.

Begin your subscription to The Sevens Report right now by clicking this link and being redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report